Private Health Insurance in the UK: What You Need to Know in 2025

Feeling frustrated with long NHS waiting lists? You’re not alone. Many Brits turn to private health insurance for faster appointments, more choice, and peace of mind. But before you sign up, you should know exactly what you’re paying for, how costs break down, and which plan fits your lifestyle.

How Much Does Private Health Insurance Cost in 2025?

Monthly premiums vary widely, but the average private health insurance policy in England sits between £60 and £150 per month for an individual. Young, healthy adults tend to pay the lower end, while families or people with pre‑existing conditions can see bills closer to £200‑£300 each month. Age, location, and the level of cover (basic, comprehensive, or specialist) all affect the price.

Most insurers use a tiered system: a basic plan covers routine GP visits and a limited number of specialist appointments, while a comprehensive plan adds inpatient surgery, private hospital rooms, and dental or optical benefits. If you can afford a higher premium, you’ll usually get quicker access to elective procedures and a broader choice of hospitals.

Choosing the Best Private Health Insurance Plan

Start by listing what matters most to you. Is it short waiting times for surgery? Do you need dental and vision coverage bundled in? Once you have a priority list, compare policies side by side. Look at the annual limit (how much the insurer will pay each year), the excess you’ll pay for each claim, and any exclusions that could bite you later.

Don’t forget to check if your employer offers a group plan. Company‑provided cover often comes at a lower cost because the risk is spread across many employees. If you’re self‑employed, consider a policy that lets you add family members later without a huge price jump.

Finally, read the fine print on waiting periods for pre‑existing conditions. Most policies require a 12‑month “medical underwriting” period before they’ll cover illnesses you already have. Knowing this up front can save you surprise refusals when you need care.

Private health insurance isn’t a one‑size‑fits‑all product. By understanding the cost structure, weighing your health priorities, and shopping around, you can pick a plan that gives you the speed and choice you want without breaking the bank.

Do Most Americans Have Private Health Insurance? Here's What the Data Shows

About 55% of Americans have private health insurance, mostly through employers, but public programs cover more people overall. High costs and gaps in coverage leave millions struggling to afford care.

Disadvantages of Private Healthcare in the UK - What You Need to Know

Explore the key drawbacks of private healthcare in the UK, including high costs, equity gaps, variable quality, and regulatory challenges, to make an informed decision.

Can You Really Buy Private Health Insurance in the US? Everything You Should Know in 2025

Can you buy private health insurance in the US? We break down your options, clear up confusion, and share the smartest ways to get coverage right now.

Private Health Insurance: The Real Reason People Get It

Private health insurance isn’t just about skipping the hospital queue. It’s all about having control over your own healthcare decisions—from choosing your doctor to picking a nicer hospital room. This article unpacks the biggest benefit and gives you tips to squeeze the most value out of your private cover. You'll get a clear look at what sets private insurance apart from relying only on public healthcare. Expect a mix of need-to-know details and real-world advice for anyone thinking about making the switch.

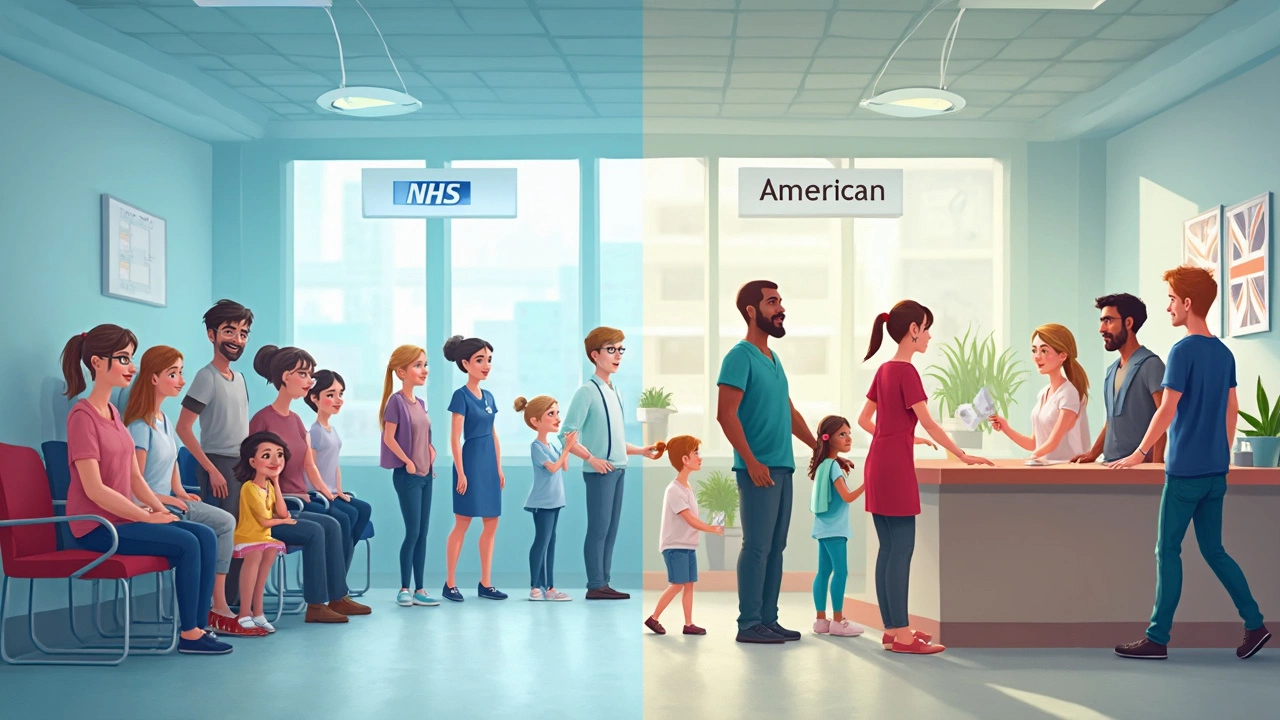

US vs UK Healthcare: Which System Works Better for You?

Figuring out whether the US or UK healthcare system is better isn't as simple as it sounds, especially if you care about costs, waiting times, and access to care. This article breaks down how each country handles insurance, doctor visits, emergencies, and the fine print that could mess with your wallet or your sanity. We’ll look at what it actually feels like to use the NHS versus American private insurance. Plus, you’ll get tips on what to watch out for if you’re moving or traveling between the two. It’s everything you need to know about picking the system that really works for you and your family.

What Are the Disadvantages of Going Private in Healthcare?

Thinking of switching to private healthcare? While it might seem like an attractive option with promises of quick treatments and specialized attention, there are drawbacks to consider. From unexpected costs to the lack of certain emergency services, going private isn't always the smooth ride one might expect. Getting the full picture of what this decision entails can help make an informed choice about your health care options.