Jan, 12 2026

Jan, 12 2026

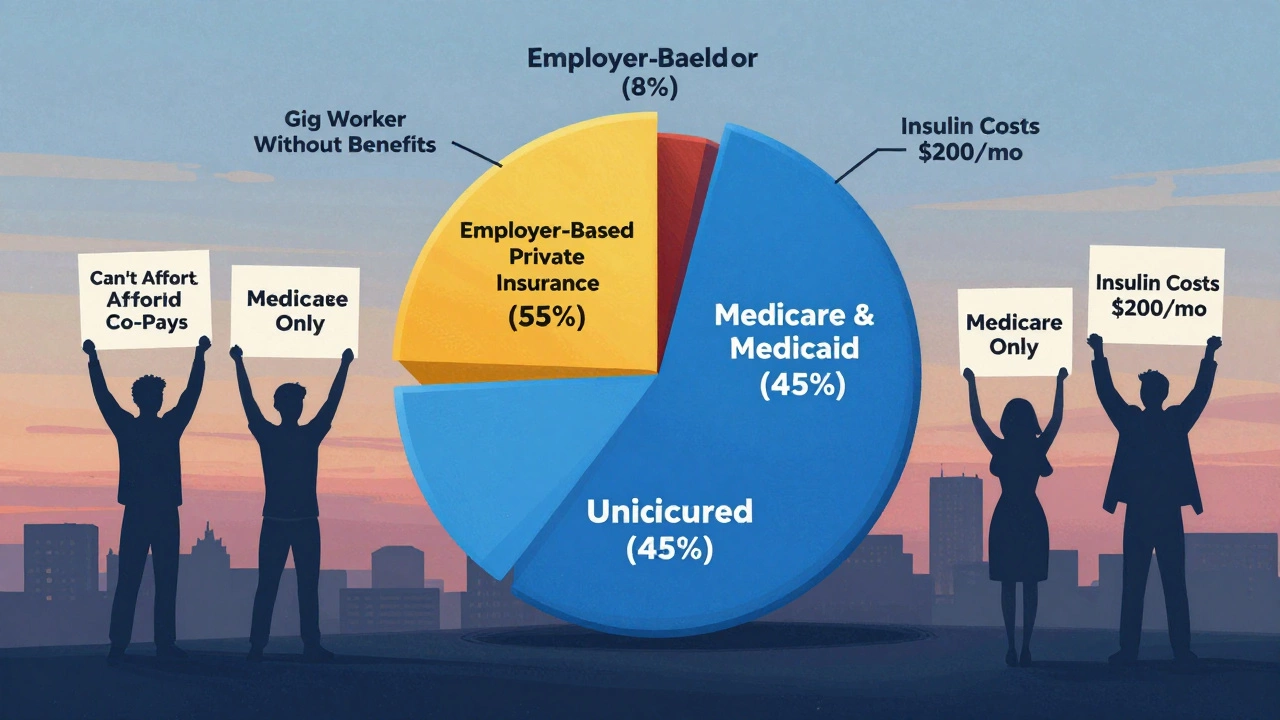

Over 180 million Americans have private health insurance. That’s more than half the population - but it’s not the whole story. Many people assume private insurance means everyone’s covered, safe, and secure. The truth? It’s messy, uneven, and leaves millions behind.

How private health insurance works in the U.S.

In the United States, private health insurance isn’t something you buy off the shelf like car insurance. Most people get it through their jobs. Employers pay part of the premium, and employees chip in the rest through payroll deductions. This system started during World War II when wage controls pushed companies to offer health benefits as a way to attract workers. Today, about 159 million people get coverage this way.

But not everyone works for a company that offers health benefits. Gig workers, part-timers, freelancers, and small business employees often don’t get access. For them, buying insurance on the open market is expensive. A single person’s plan can cost $500 a month or more, even with subsidies. That’s why nearly 30 million Americans remain uninsured - not because they don’t want coverage, but because they can’t afford it.

Who has private insurance, and who doesn’t?

The data breaks down in predictable ways. People with full-time jobs at mid-sized or large companies are most likely to have private insurance. Over 90% of workers at firms with 200+ employees get coverage. At small businesses with fewer than 10 workers, that number drops to about 50%.

Age matters too. Young adults under 26 often stay on their parents’ plans. After that, many drop out - either because they’re uninsured or they switch to Medicaid if they qualify. Seniors over 65 mostly leave private insurance behind and enroll in Medicare, a federal program. About 65 million Americans are on Medicare, and while it’s government-run, many pair it with private supplemental plans called Medigap.

Low-income families rely on Medicaid, which is state-run but funded by the federal government. It’s not private insurance - it’s public. But it covers 85 million people, making it the largest source of health coverage in the country. So when people say “most Americans have private insurance,” they’re forgetting about Medicaid and Medicare enrollees.

Private insurance isn’t the same as good care

Having private insurance doesn’t mean you’re protected from financial ruin. High deductibles are the norm. Many plans have $5,000 or more in out-of-pocket costs before the insurer starts paying much. That means even if you have coverage, you might skip a doctor’s visit because you can’t afford the copay.

A 2024 study from the Kaiser Family Foundation found that 42% of privately insured adults said they had trouble paying medical bills in the past year. One in five had to borrow money or go into debt to cover health expenses. Private insurance helps, but it doesn’t eliminate cost shocks.

And then there’s the network problem. Your plan might cover a hospital, but not the anesthesiologist who works there. Or your specialist might be out-of-network, even if your primary care doctor is in-network. Surprise bills are still common, despite laws meant to stop them.

What about public programs?

Medicare and Medicaid cover nearly 150 million Americans combined. That’s more than the number of people with private insurance through employers. Add in military coverage (TRICARE), Veterans Affairs, and Indian Health Service, and you’re looking at over 200 million people covered by public or government-linked programs.

So when you hear “most Americans have private insurance,” remember: that doesn’t mean most Americans rely on private insurance as their primary source of care. It just means private insurance is the largest single slice of the pie - but not the whole pie.

The real gap: affordability and access

The biggest issue isn’t whether people have insurance. It’s whether their insurance actually works when they need it.

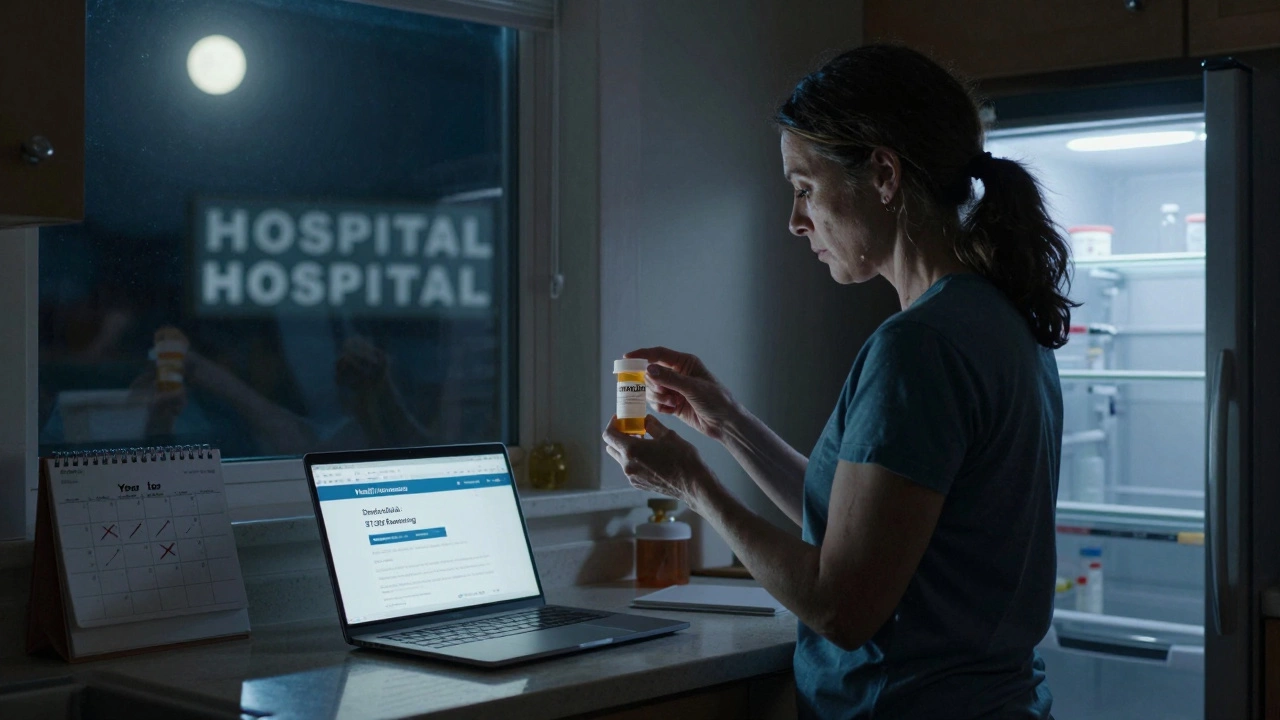

One woman in Ohio, 48, works two part-time jobs. She has a plan through one employer, but her deductible is $7,500. She hasn’t seen a doctor in three years because she can’t afford the co-pays. She’s insured - but she’s not cared for.

Another man in Texas, 52, lost his job during the pandemic. He got COBRA for six months, then switched to a marketplace plan. His monthly premium is $850. He pays $200 a month for insulin. He’s not eligible for Medicaid because his state didn’t expand it. He’s stuck.

These aren’t outliers. They’re the norm for millions.

Is private insurance the answer?

Private insurance works well for some - especially those with good employer plans and high incomes. But it fails for those who need it most: low-wage workers, the self-employed, people with chronic conditions, and those living in states that refused Medicaid expansion.

Other wealthy countries use universal systems. Canada, the UK, Germany, Australia - they all guarantee coverage as a right, not a privilege. Their systems aren’t perfect, but they don’t leave people choosing between rent and medication.

The U.S. spends more per person on health care than any other country - over $13,000 annually - yet ranks last among high-income nations in access, efficiency, and equity. Private insurance is part of the problem, not the solution.

What’s changing?

There are signs of movement. More states are expanding Medicaid. The Inflation Reduction Act capped insulin at $35 a month for Medicare recipients - a policy that could expand. Some employers are starting to pay off employee medical debt.

But without systemic change, private insurance will keep serving those who can afford it - and leaving everyone else to navigate a broken system alone.

Do most Americans have private health insurance?

Yes, about 180 million Americans - roughly 55% of the population - have private health insurance, mostly through employers. But that doesn’t mean most Americans rely on it as their main source of care. Over 150 million are covered by Medicare or Medicaid, making public programs the largest source of coverage overall.

Is private health insurance affordable for most people?

No, affordability is a major issue. Even with insurance, many Americans face high deductibles - often $5,000 or more - and out-of-pocket costs that make care unaffordable. A 2024 study found 42% of privately insured adults struggled to pay medical bills in the past year. Premiums, copays, and surprise bills add up fast.

What percentage of Americans are uninsured?

About 8% of Americans, or roughly 26 million people, were uninsured in 2024. That number has dropped since the Affordable Care Act, but progress has stalled. Many uninsured people live in states that didn’t expand Medicaid and earn too much to qualify for subsidies but not enough to afford private plans.

Does having private insurance mean you get better care?

Not necessarily. People with private insurance often face restricted provider networks, surprise bills, and high out-of-pocket costs. Those on Medicaid or Medicare may have better access to preventive care and lower costs for chronic conditions. Quality of care depends more on income, location, and provider than the type of insurance.

Why do so many Americans have employer-based insurance?

It started in the 1940s during World War II, when wage controls led companies to offer health benefits as a way to attract workers. Over time, this became the standard. Today, 159 million Americans get coverage through their jobs. But this system leaves out gig workers, freelancers, and those employed by small businesses that can’t afford to offer insurance.