Health Insurance Basics: What You Need to Know Today

Whether you live in the UK, the US, or are planning a trip, figuring out health insurance can feel like a maze. You’re probably asking: how much will it cost? Do I even need private cover when there’s the NHS? And what happens if I move between countries? This page pulls together the most common questions and gives you straight‑forward answers so you can make a smart decision without getting lost in jargon.

How Much Does Health Insurance Really Cost?

Cost is the biggest driver for most people. In the UK, private health insurance typically starts around £30‑£40 a month for basic coverage, but premiums jump to £100‑£150 for comprehensive plans that include dental, optical, and fast‑track surgery. In the US, the range is far wider – a single adult can pay $200‑$600 a month for a decent marketplace plan, while family coverage often tops $1,200. Your age, health status, and where you live all play a part. For example, a 30‑year‑old in London will pay less than a 55‑year‑old in Manchester, just as a 25‑year‑old in Ohio will pay less than a senior in California.

Remember, the headline price isn’t the whole story. Look at deductibles, co‑pays, and what services are actually covered. A cheap plan that leaves you with high out‑of‑pocket bills for prescriptions or specialist visits can end up costing way more in the long run.

Private Cover vs Public Options: Which Is Right for You?

The UK’s NHS offers free treatment at the point of use, but it can come with long waiting lists for non‑urgent procedures. Private insurance lets you bypass those queues, pick your own doctor, and often get quicker access to elective surgery. If you value speed and choice, a private policy makes sense, especially if you have a chronic condition that needs regular specialist care.

In the US, there’s no universal public system, so most people rely on private insurance, employer‑provided plans, or government programs like Medicare and Medicaid. If you’re an American expat living in the UK, your US plan usually won’t cover NHS services, so you’ll need a local policy or travel insurance for short stays.

For travelers, a short‑term travel insurance policy can fill gaps when you’re abroad. It usually covers emergency care, evacuation, and sometimes even routine doctor visits if you’re outside your home country’s network.

Choosing the right plan boils down to three questions: how often do you use health services, how much can you afford each month, and how fast do you need care when something comes up. Write down your typical medical needs, compare monthly premiums against potential out‑of‑pocket costs, and check whether your preferred doctors are in‑network.

Finally, keep an eye on policy reviews. Insurers often adjust rates each year, and new regulations can change what’s covered. A quick annual check can save you cash and make sure your coverage still matches your life.

Do Most Americans Have Private Health Insurance? Here's What the Data Shows

About 55% of Americans have private health insurance, mostly through employers, but public programs cover more people overall. High costs and gaps in coverage leave millions struggling to afford care.

Is UK Healthcare Free for US Citizens? What You Need to Know

Find out if the UK's NHS is free for US citizens, what charges apply, and how to avoid unexpected bills during your visit.

Can You Really Buy Private Health Insurance in the US? Everything You Should Know in 2025

Can you buy private health insurance in the US? We break down your options, clear up confusion, and share the smartest ways to get coverage right now.

Private Health Insurance UK Monthly Cost: What to Expect in 2025

Curious about private health insurance costs in the UK for 2025? Explore monthly prices, real-life examples, tips, and things everyone should know before choosing a policy.

How Much Does Health Insurance Cost in England? A 2025 Guide to Private Coverage

Uncover what people in England actually pay for private health insurance, who buys it, what influences the price, and what you might need to know if considering a policy in 2025.

Best Health Insurance Companies 2025: Honest Guide to Top Providers

An honest, detailed look at which company gives the best health insurance in 2025. Get facts, practical advice, and real comparisons to pick the best plan for your needs.

Private Health Insurance UK: Why Pay for Cover in an NHS System?

Unlock the real reasons people in the UK get private health insurance: faster treatment, choice, convenience, peace of mind, and more. Dive into the facts and tips.

Do You Need Health Insurance in the UK? Understanding NHS, Private Options, and Law

Find out if health insurance is mandatory in the UK, how the NHS works, and what private policies offer. Get the facts and smart tips for staying covered.

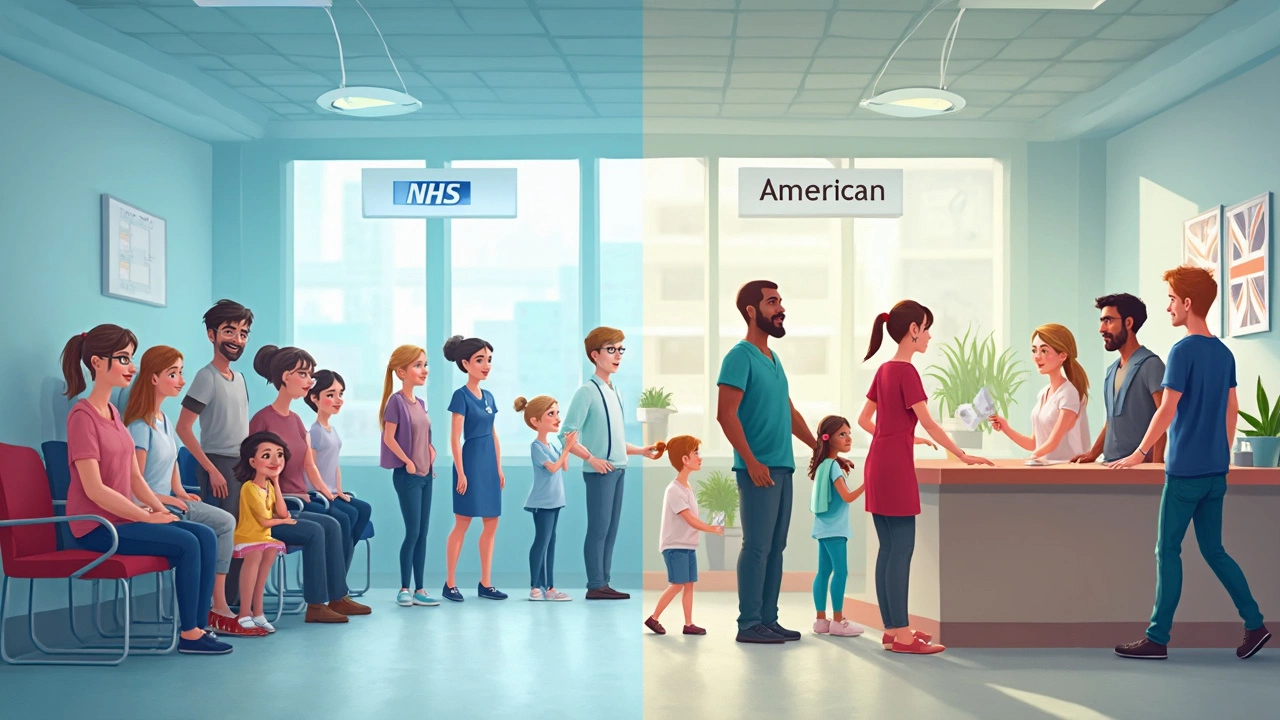

Is Healthcare Better in the UK or US? Insurance, Costs, and Real-Life Impact

Ever wondered whether healthcare is better in the UK or the US? This article compares how both countries handle insurance, costs, patient experiences, and everyday challenges. You'll find clear points about the strengths and downsides of each system, plus handy tips for dealing with healthcare from both sides. If you're considering a move or just want to understand your options, this is packed with practical info.

US vs UK Healthcare: Which System Works Better for You?

Figuring out whether the US or UK healthcare system is better isn't as simple as it sounds, especially if you care about costs, waiting times, and access to care. This article breaks down how each country handles insurance, doctor visits, emergencies, and the fine print that could mess with your wallet or your sanity. We’ll look at what it actually feels like to use the NHS versus American private insurance. Plus, you’ll get tips on what to watch out for if you’re moving or traveling between the two. It’s everything you need to know about picking the system that really works for you and your family.

Can a US Citizen Get Free Healthcare in the UK?

Ever wondered if you can walk into a UK hospital and get treated without pulling out your wallet just because you carry a US passport? This article breaks down how the NHS works, who actually qualifies for free care, and what US citizens really get when it comes to British healthcare. You’ll find practical tips to avoid nasty surprises, real examples of costs, and everything you need to know about travel insurance. Skip the rumors and get the straight facts, whether you’re planning a quick visit or something longer.

Is Surgery Free in the UK? What You Need to Know About Healthcare and Costs

Wondering if surgery is really free in the UK? This article uncovers how the NHS covers surgery, where private care fits in, and what exceptions exist. Find out how residency and certain life situations affect your access and what costs might surprise you. Learn about waiting times, hidden fees, and insurance tips. Get straightforward advice on making the best choice for your health without worrying about your budget.