Dec, 7 2025

Dec, 7 2025

Medicare Savings Program Eligibility Calculator

Check Your Eligibility

Important: These are 2025 income limits only. Resource limits apply (up to $9,660 for single, $14,490 for couple). Your primary home and one vehicle are not counted as resources.

Medicare doesn’t have a single income cutoff to qualify for basic coverage. If you’re 65 or older, or have certain disabilities, you’re eligible for Medicare Part A and Part B regardless of how much you make. But if you’re struggling to pay for prescriptions, doctor visits, or out-of-pocket costs, there are programs that lower your expenses - and those do have income limits.

Medicare Basics: You Don’t Need Low Income to Get It

Most people get Medicare when they turn 65, no matter their income. If you’ve paid into Social Security for at least 10 years, Part A (hospital insurance) is free. Part B (medical insurance) costs $174.70 per month in 2025 for most people, but higher earners pay more due to income-related monthly adjustment amounts (IRMAA).

That’s the first thing to understand: Medicare itself doesn’t turn you away because you’re low income. But the real problem isn’t getting enrolled - it’s affording the costs after enrollment. Deductibles, copays, coinsurance, and especially prescription drugs can add up fast. That’s where the Medicare Savings Programs (MSPs) and Extra Help come in.

Medicare Savings Programs: Lower Your Out-of-Pocket Costs

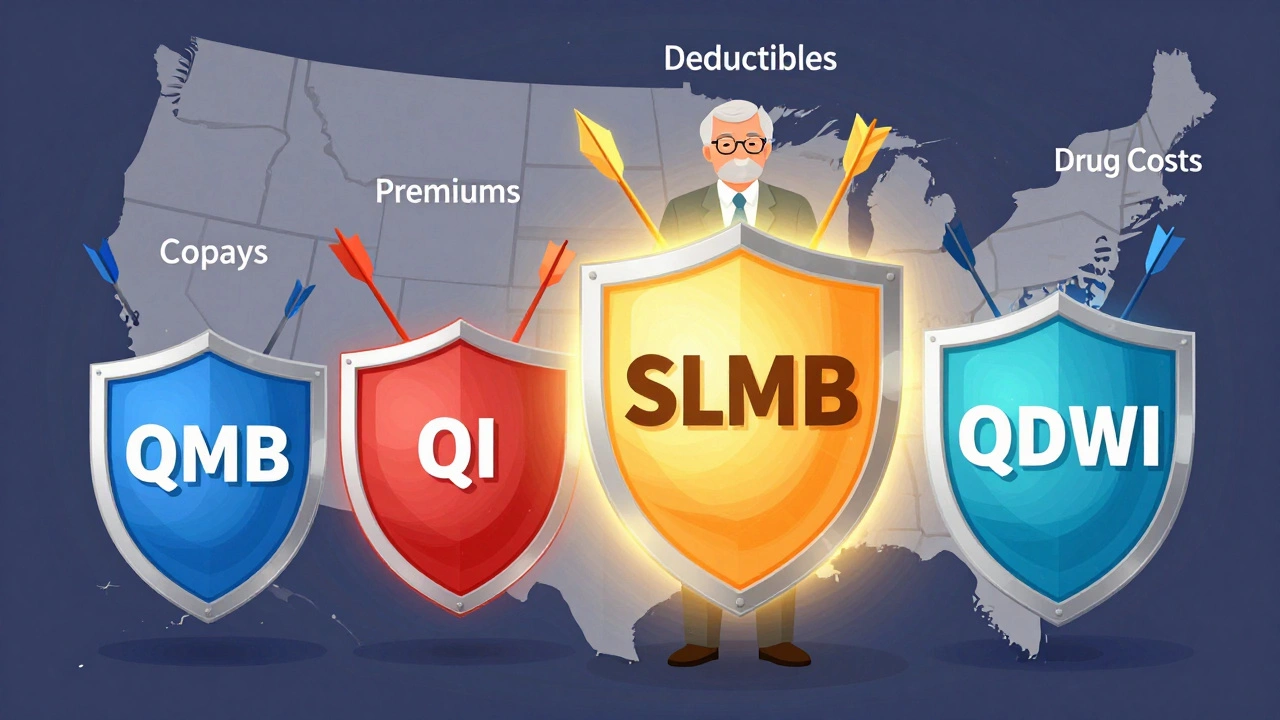

If your income and resources are limited, you might qualify for one of four Medicare Savings Programs. These are run by your state’s Medicaid agency and help pay for Medicare Part A and Part B premiums, and sometimes coinsurance and deductibles.

Here are the four types, listed from most to least generous:

- Qualified Medicare Beneficiary (QMB) - Pays your Part A and Part B premiums, plus deductibles, coinsurance, and copays. You can’t be billed for these costs by providers.

- Specified Low-Income Medicare Beneficiary (SLMB) - Pays only your Part B premium.

- Qualifying Individual (QI) - Also pays only your Part B premium, but funding is limited each year, so not everyone who qualifies gets help.

- Qualified Disabled and Working Individuals (QDWI) - Helps people under 65 who are disabled and working, by paying their Part A premium.

Income limits for 2025 are based on federal poverty levels (FPL). For a single person:

- QMB: Income up to $1,255/month ($15,060/year)

- SLMB: Income up to $1,420/month ($17,040/year)

- QI: Income up to $1,585/month ($19,020/year)

- QDWI: Income up to $4,890/month ($58,680/year) - but you must have resources under $4,000

For a couple, the limits are higher:

- QMB: Income up to $1,694/month ($20,328/year)

- SLMB: Income up to $2,284/month ($27,408/year)

- QI: Income up to $2,536/month ($30,432/year)

Resource limits (what you own) also apply. In 2025, you can have up to $9,660 in resources as a single person, or $14,490 as a couple. This includes bank accounts, stocks, and second homes - but not your primary home, one car, or personal belongings.

Extra Help: Lower Your Prescription Drug Costs

If you’re paying a lot for medications, the Extra Help program (also called the Low-Income Subsidy or LIS) can cut your Part D drug plan costs dramatically. In 2025, it can save you up to $5,000 a year on prescriptions.

Extra Help covers:

- Monthly premiums for your Part D plan

- Annual deductibles (often $0)

- Copays for prescriptions (as low as $4.70 for generics, $11.80 for brand-name drugs)

- Coverage in the donut hole (the gap where you pay more after hitting a spending limit)

Income and resource limits for Extra Help in 2025:

- Single person: Income under $21,590/year ($1,799/month), resources under $16,640

- Couple: Income under $29,170/year ($2,430/month), resources under $33,240

Resources include cash, bank accounts, investments, and second properties. Your home, car, and personal items don’t count. If you get full Medicaid, Supplemental Security Income (SSI), or a Medicare Savings Program, you’re automatically enrolled in Extra Help.

What Happens If You’re Just Above the Limit?

Many people are frustrated because they earn just a little too much to qualify - say, $1,800 a month - but still can’t afford their prescriptions. In those cases, you’re not out of options.

Some states offer additional state-specific assistance programs for people who don’t qualify for federal aid. For example, California’s Medicare Savings Program has a higher income limit than the federal standard in some cases. Others have pharmaceutical assistance programs run by nonprofits or drug manufacturers.

Also, you can ask your Part D plan for a “formulary exception” if your drug isn’t covered or is too expensive. Or request a “tiering exception” to get a brand-name drug at a lower cost-sharing level. Many plans will approve these if you show financial hardship.

How to Apply

You can apply for Medicare Savings Programs and Extra Help in three ways:

- Online - Go to SSA.gov and use the Extra Help application. It also lets you apply for QMB, SLMB, and QI.

- By phone - Call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

- In person - Visit your local Social Security office. Bring your Medicare card, proof of income (pay stubs, tax returns, Social Security award letter), and proof of resources (bank statements).

Applications usually take 30 to 45 days to process. If you’re approved, benefits start the month after you apply - and you can get retroactive coverage for up to three months if you were eligible during that time.

Common Mistakes That Cause Denials

People often get denied because they:

- Forget to report all income sources - including pensions, interest, and rental income

- Don’t list all assets - like a savings account they forgot about

- Assume they’re too rich because they own a home - but your primary home doesn’t count

- Wait too long to apply - you can apply anytime, even mid-year

- Don’t reapply annually - income limits change, and your eligibility might shift

Even if you’re denied, you can appeal. Many approvals happen on appeal after providing additional documentation.

Real-Life Example: Maria’s Story

Maria, 72, lives in Ohio on a $1,600 monthly Social Security check. She takes six medications, including insulin and a blood thinner. Her Part D plan costs $85/month, and her copays added up to $320 a month. She thought she made too much for help.

After applying for Extra Help, she found out she qualified. Her monthly drug costs dropped to $15. Her Part B premium was covered by SLMB. She saved $3,500 in one year.

She didn’t know she was eligible because she assumed Medicare was only for people on welfare. She wasn’t - but she was eligible for the safety nets built into the system.

Bottom Line: You Might Qualify Even If You Think You Don’t

There’s no single answer to “What’s the lowest income to qualify for Medicare?” because Medicare itself doesn’t require low income. But if you’re struggling with prescription costs, the real question is: Do you qualify for help paying for it?

The answer for many is yes - even if you make $2,000 a month, own your home, and have a small savings account. The limits are higher than most people think. And if you’re denied, you can reapply or appeal.

Don’t assume you’re ineligible. Apply. Even if you don’t get approved right away, you might get help later - or find a way to lower your costs through other programs. Every dollar saved on prescriptions means one less choice between medicine and groceries.

Can I get Medicare if I have a high income?

Yes. Medicare Part A and Part B are available to anyone 65 or older who’s eligible for Social Security, regardless of income. Higher earners pay more for Part B and Part D premiums, but they’re still covered. Income only affects how much you pay - not whether you qualify.

Does owning a home disqualify me from Medicare savings programs?

No. Your primary home is not counted as a resource when determining eligibility for Medicare Savings Programs or Extra Help. Only liquid assets like bank accounts, stocks, and second properties are considered.

Can I apply for Extra Help if I’m under 65?

Yes. If you’re under 65 and qualify for Medicare due to a disability, you can apply for Extra Help. The income and resource limits are the same as for those 65 and older.

How often do I need to reapply for Medicare savings programs?

You must reapply every year. Social Security automatically reviews your eligibility using tax data, but if your income or resources change, you should update your information. Some states require a formal renewal form - check with your state Medicaid office.

What if I’m denied for Extra Help but still can’t afford my drugs?

You can appeal the denial. You can also ask your Part D plan for a formulary or tiering exception. Many drug manufacturers offer patient assistance programs. Nonprofits like NeedyMeds and RxAssist list free or low-cost medication options. Contact your local Area Agency on Aging - they often have case managers who help with this.