Oct, 27 2025

Oct, 27 2025

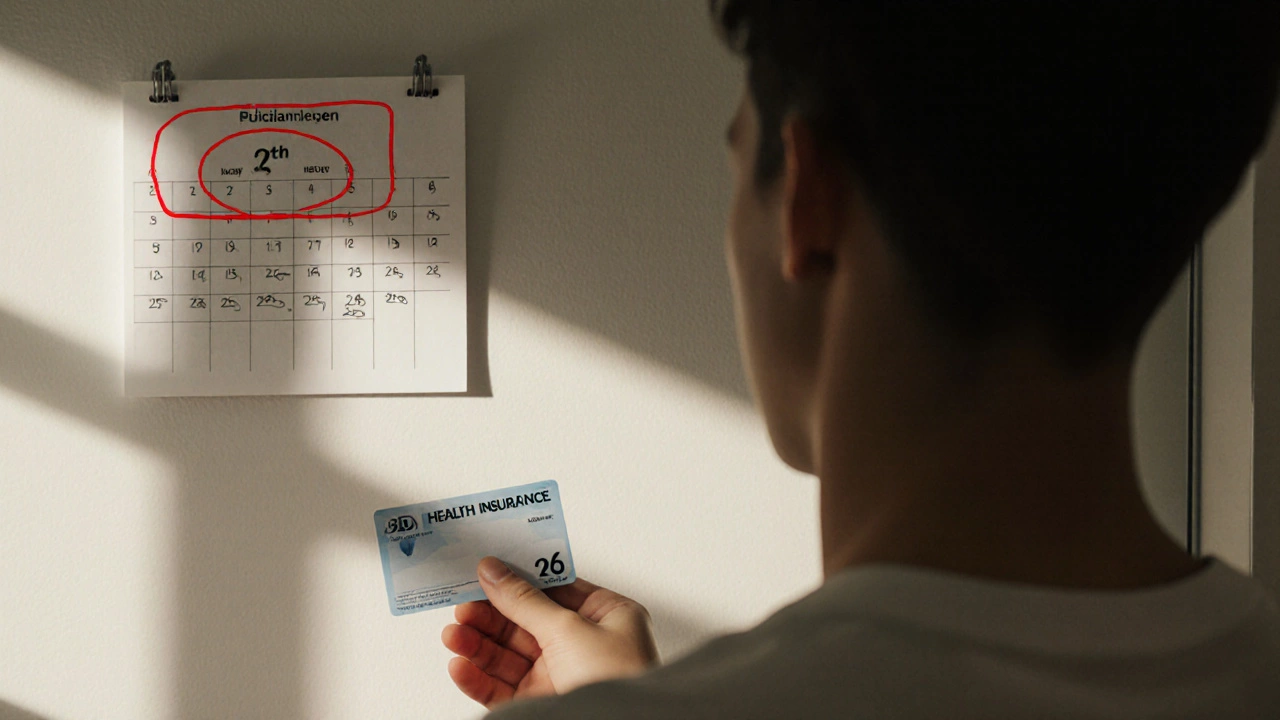

When Does My Insurance Coverage End?

Find out exactly when your parents' health insurance coverage ends based on your birthdate. The Affordable Care Act requires coverage to end on your 26th birthday.

Key Things to Know

• Most plans end coverage on your 26th birthday (no exceptions for marriage or financial independence)

• Dental/vision plans may have different rules (sometimes until age 30)

• If you're disabled, you may qualify for Medicaid/Medicare before age 26

• If you miss the 60-day window, you'll have to wait until next year's Open Enrollment

Most people assume health insurance lasts forever-until they get a bill they didn’t expect. If you’re under 26, you’re likely still on your parents’ plan. But what happens after that? When does private insurance stop covering you? The answer isn’t as simple as a single age, but there’s a clear turning point most people hit.

Most private plans drop you at 26

In the United States, the Affordable Care Act made it legal for young adults to stay on their parents’ private health insurance until they turn 26. This rule applies to almost all plans, whether bought through an employer, the marketplace, or directly from an insurer. It doesn’t matter if you’re married, living on your own, going to school, or financially independent. As long as your parent’s plan allows dependents, you’re covered until your 26th birthday.

That’s it. On the day you turn 26, coverage ends. No grace period. No extension. If you don’t act, you’ll be uninsured the next day. Many people don’t realize this until they get a medical bill or try to refill a prescription and find their card doesn’t work anymore.

Why 26? It’s not about maturity-it’s about policy design

There’s no medical reason you stop needing care at 26. But the age was chosen because it’s the last point before most people are expected to have their own income and employer-sponsored coverage. Before the ACA, many insurers cut off dependents at 18 or 19, even if they were still in college. That left young adults with huge gaps in care. The 26 rule was a fix-not a perfect one, but a major improvement.

It’s also not a universal rule. Some plans, especially those offered by religious organizations or grandfathered policies, might have different rules. But those are rare. For 95% of people, 26 is the hard stop.

What happens when you turn 26? You get a special enrollment window

When your coverage ends, you qualify for a Special Enrollment Period (SEP). This lets you sign up for a new plan outside the usual open enrollment window. You have 60 days before and after your 26th birthday to enroll in a new plan through the Health Insurance Marketplace.

Don’t wait. If you miss this window, you’ll have to wait until the next open enrollment period-usually November to January-with coverage starting the following January. That could leave you without insurance for months. And if you get sick or injured during that time, you’ll pay full price.

You can also get coverage through an employer. If you start a new job, your employer’s plan likely lets you enroll right away. Some employers even offer coverage the first day. Check with HR. If you’re unemployed or self-employed, you can buy a plan directly from an insurer or through the marketplace. Premiums vary, but subsidies are available if your income is below 400% of the federal poverty level.

What if your parents’ plan doesn’t cover you after 26?

Some parents think they can keep their child on the plan longer. They can’t. The law says 26 is the maximum. Even if the plan allows it, insurers will reject claims after that age. There’s no loophole.

But here’s something many don’t know: if your parent’s plan is a grandfathered plan-meaning it existed before March 23, 2010, and hasn’t changed much-you might still be covered past 26. These plans are rare now. Most have updated to comply with current rules. If you’re unsure, call the insurer and ask: “Is this a grandfathered plan under the ACA?” If yes, ask about dependent coverage rules. If no, you’re still cut off at 26.

What about dental or vision coverage?

Dental and vision plans often follow different rules. Some allow dependents to stay on until 30. Others follow the same 26 cutoff. It depends on the plan. Check your documents. If you’re losing dental coverage at 26 and you need braces, cleanings, or fillings, you’ll need to find a new plan or pay out of pocket. Standalone dental plans are cheaper than medical ones and can be bought directly from providers like Delta Dental or Cigna.

Same goes for vision. If you wear contacts or glasses, losing vision coverage can cost hundreds a year. Don’t assume it stays with your medical plan. Verify separately.

What if you’re disabled or have special needs?

If you have a disability that prevents you from working, you might qualify for Medicaid or Medicare before 65. Medicaid eligibility is based on income and disability status, not age. If you’re approved, you’ll get coverage regardless of your 26th birthday.

Some states offer extended dependent coverage for disabled children. For example, New Jersey allows coverage until age 31 if the child is disabled and financially dependent. California has a similar rule for those with developmental disabilities. These are exceptions, not the norm. You’ll need to apply separately and prove eligibility.

What about international plans or expats?

If you live outside the U.S., the 26 rule doesn’t apply. Many countries have public healthcare systems that cover young adults until they’re financially independent. In the UK, for example, you stay on the NHS until you turn 18. After that, you’re on your own unless you’re in full-time education.

Private international plans vary. Some expat insurers let you stay on your parents’ plan until 25, others until 30. Always read the fine print. If you’re moving abroad, consider local coverage or a global health plan designed for young adults.

What if you’re still in school?

Being in college doesn’t extend your coverage. You’re still cut off at 26. Many students assume their student health plan will cover them after they turn 26. It won’t. Student plans are usually short-term and only active while enrolled. If you’re a senior in college and turning 26 next semester, you need to plan ahead. Don’t wait until your last class to find insurance.

Some universities offer extended coverage for graduates for up to six months. But that’s not guaranteed. Contact your school’s health services office early. If they don’t offer it, start looking at marketplace plans or employer options.

What are the risks of going uninsured after 26?

One ER visit for appendicitis can cost $10,000 or more. Without insurance, you pay it all. Even a broken bone can run $5,000. A simple blood test might cost $200. If you’re on a tight budget, these bills can ruin your credit or lead to collections.

And it’s not just emergencies. Chronic conditions like asthma, diabetes, or anxiety need regular care. Without insurance, you skip appointments. You ration meds. You delay treatment. That leads to worse outcomes-and higher costs down the road.

Preventive care like vaccines, cancer screenings, and annual checkups are free under most plans. But only if you’re insured. Once you’re uninsured, those services become expensive. You lose access to early detection. That’s how small problems become big ones.

What should you do before you turn 26?

Start planning at least 6 months before your birthday. Here’s what to do:

- Call your parent’s insurer. Confirm your last day of coverage.

- Check if your employer offers health insurance. Ask about start dates and waiting periods.

- Visit Healthcare.gov or your state’s marketplace. Use the subsidy calculator to see if you qualify for financial help.

- Compare plans: look at monthly premiums, deductibles, and out-of-pocket maximums. Don’t just pick the cheapest monthly payment.

- Consider a Health Savings Account (HSA) if you pick a high-deductible plan. You can save pre-tax money for medical costs.

- Enroll before your birthday. Don’t wait until the last week.

If you’re unsure, talk to a licensed insurance agent. They can help you compare plans and apply. Many offer free consultations.

Can you stay on your parents’ plan if you’re not a dependent?

No. The rule doesn’t care if you’re financially independent, married, or living in another state. You’re covered until 26 regardless of your life situation. But you can’t stay on after that-even if your parents want you to. The insurer won’t allow it.

Some parents try to add their adult child back on as a dependent after 26. That’s not possible under federal law. The only way to get coverage after 26 is through your own plan, an employer, Medicaid, or Medicare.

What if you’re on Medicare or Medicaid?

If you’re already on Medicaid or Medicare, your parents’ private plan doesn’t matter. You’re covered. But you can’t be on both at the same time. If you qualify for Medicaid based on income or disability, that’s your primary coverage. Private insurance won’t replace it.

If you’re on Medicare because of a disability, you likely qualify before 26. That means you won’t need to worry about losing coverage from your parents’ plan-you already have your own.

What’s the most common mistake people make?

Thinking they don’t need insurance because they’re healthy. Young adults often feel invincible. They skip doctor visits. They ignore symptoms. They assume nothing bad will happen to them.

But accidents don’t care how young you are. A car crash, a fall, a sudden illness-they happen. And without insurance, you’re on the hook for everything.

The second mistake? Waiting until the last minute to enroll. Special enrollment windows are strict. Miss the deadline, and you’re stuck without coverage for months.

Don’t be the person who gets a medical bill they can’t pay because they didn’t plan ahead. Turn 26 isn’t a milestone to celebrate-it’s a deadline to act on.

Can I stay on my parents’ insurance after I turn 26?

No. Federal law requires private health insurance plans to cover dependents only until age 26. Coverage ends on your 26th birthday, with no exceptions for school, marriage, or financial dependence.

What if I don’t get insurance after turning 26?

You’ll be uninsured and responsible for all medical costs. A single ER visit can cost $10,000 or more. You’ll also miss out on free preventive care like vaccines and cancer screenings. Missing the 60-day special enrollment window means waiting until next year’s open enrollment to get coverage.

Do dental and vision plans follow the same 26 rule?

Not always. Some dental and vision plans allow dependents to stay on until age 30. Others cut off at 26. Check your plan documents or call the provider directly. Don’t assume they follow the same rules as your medical insurance.

Can I get insurance through my employer after turning 26?

Yes. If you start a new job, your employer’s health plan typically lets you enroll right away. Some have a waiting period of 30 to 90 days. Ask HR for details. If you’re already employed, check if you’re eligible for coverage now.

Are there any exceptions to the 26 rule?

Yes, but they’re rare. Some grandfathered plans (existing before 2010) may allow longer coverage. Also, some states allow extended coverage for disabled dependents-up to age 30 or 31. You must apply and prove eligibility. For most people, 26 is the cutoff.