Private Health Insurance Cutoff: What Happens When Coverage Ends?

When your private health insurance cutoff, the point at which your coverage stops due to non-payment, policy expiration, or eligibility loss. Also known as health insurance termination, it doesn’t just mean you lose access to private clinics—it can force you back into the NHS system, often with long waits for the same treatment. This isn’t a technicality. It’s a life shift. People who’ve grown used to skipping queues for hip replacements, MRI scans, or specialist appointments suddenly find themselves back on waiting lists that stretch months—or even years—long.

Most people don’t realize how tightly their care depends on that monthly payment. A private healthcare UK, a system where patients pay for faster access to doctors, tests, and surgeries outside the NHS works only as long as the insurance is active. Once it drops, you’re no longer in the fast lane. You’re in the same line as everyone else. And if you’re dealing with chronic pain, nerve damage, or a condition that needs timely intervention, that delay can make things worse. Some end up paying out-of-pocket for urgent care just to avoid NHS delays, which can cost more than the original premium.

The NHS waiting times, the average length patients wait for non-emergency treatment under the UK’s public healthcare system are no secret. But when your insurance cuts off, those wait times stop being abstract numbers—they become your reality. A knee operation that took 6 weeks under insurance might now take 18. A consultation with a neurologist for nerve pain? Maybe 9 months. That’s not hypothetical. That’s what people in the UK face every day after losing coverage.

And it’s not just about timing. Private insurance often covers drugs, therapies, or specialists the NHS doesn’t routinely offer—like certain pain management programs, advanced physiotherapy, or even psychological support for chronic conditions. Lose your coverage, and you lose those options too. No one warns you about this when you sign up. You think you’re buying convenience. You’re really buying stability. And when that stability vanishes, the fallout hits fast.

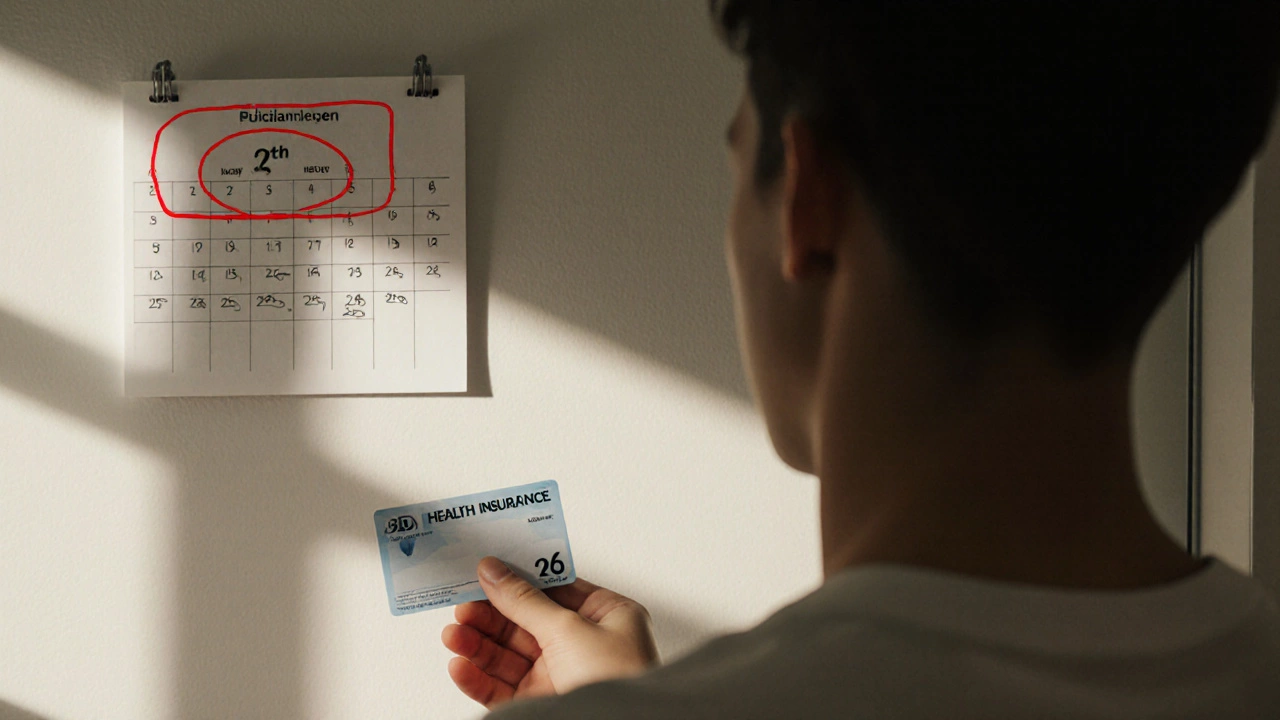

That’s why understanding your policy’s fine print matters—not just when you sign up, but every year. When does it renew? What happens if you miss a payment? Are there grace periods? Can you switch plans without a gap? These aren’t just administrative questions. They’re survival questions. And if you’ve been relying on private care to manage pain, avoid surgery, or keep moving, a cutoff isn’t a hiccup—it’s a crisis.

Below, you’ll find real stories and practical breakdowns from people who’ve been through this. From how to appeal a cancellation, to what NHS services you can still access, to the hidden costs of going private then losing coverage—this collection doesn’t sugarcoat it. It shows you what happens when the safety net disappears—and what you can do before it does.

What Age Do You Lose Insurance Coverage? Private Health Rules Explained

Most private health insurance plans stop covering you at age 26. Learn when coverage ends, what options you have after, and how to avoid being left uninsured.