Out-of-Pocket Costs: What You Really Pay for Healthcare in the UK and Beyond

When you walk into a clinic, hospital, or pharmacy, out-of-pocket costs, the money you pay directly for medical services without insurance coverage. Also known as direct healthcare expenses, these are the bills that hit your wallet after insurance, if any, has paid its share. It doesn’t matter if you’re in London or Los Angeles—these costs are what make healthcare feel real, not theoretical. They’re the £120 for a private MRI, the £30 for a prescription not covered by the NHS, or the £2,000 you shell out for a dental implant because your insurance won’t touch it.

Out-of-pocket costs don’t exist in a vacuum. They’re tied directly to private healthcare, a system where you pay for faster access, better amenities, or treatments the NHS doesn’t offer. In the UK, private healthcare can mean skipping months-long NHS waits—but it also means you’re on the hook for everything from consultations to follow-ups. Meanwhile, in the US, even people with insurance often face high deductibles, co-pays, and uncovered services. A 2023 study found that nearly 4 in 10 Americans skipped care because they couldn’t afford the out-of-pocket price, even with coverage. That’s not just inconvenient—it’s dangerous.

These costs also connect to medical expenses, the full range of spending on treatments, medications, and procedures that aren’t fully subsidized. Think of gabapentin side effects that require extra doctor visits, or a tummy tuck abroad that seems cheap until you factor in travel, aftercare, and complications. Even something as simple as finding a GP can cost you time and money if you need to pay for a private consultation just to get a referral. And when you’re dealing with chronic pain, nerve damage, or gender-affirming surgery, these costs pile up fast—sometimes pushing people into debt just to feel better.

There’s no single answer to managing these expenses. But knowing what’s covered, what’s not, and where the biggest gaps lie gives you power. You can compare the UK’s NHS to the US system and see why one spends 2.5 times more per person. You can learn why dental implants last decades but cost thousands upfront, or why top surgery funding often means grants, crowdfunding, or going overseas. You can see how private healthcare isn’t just about choice—it’s about who can afford to pay.

What follows is a collection of real, practical guides that break down exactly where your money goes. From cheaper alternatives to dental implants to the hidden fees in cosmetic surgery, from insurance cutoffs at age 26 to how to fund gender-affirming care—every post here answers the question you’re too afraid to ask: How much will this actually cost me? There’s no fluff. No marketing. Just the numbers, the options, and the truth about what you’ll pay out of your own pocket.

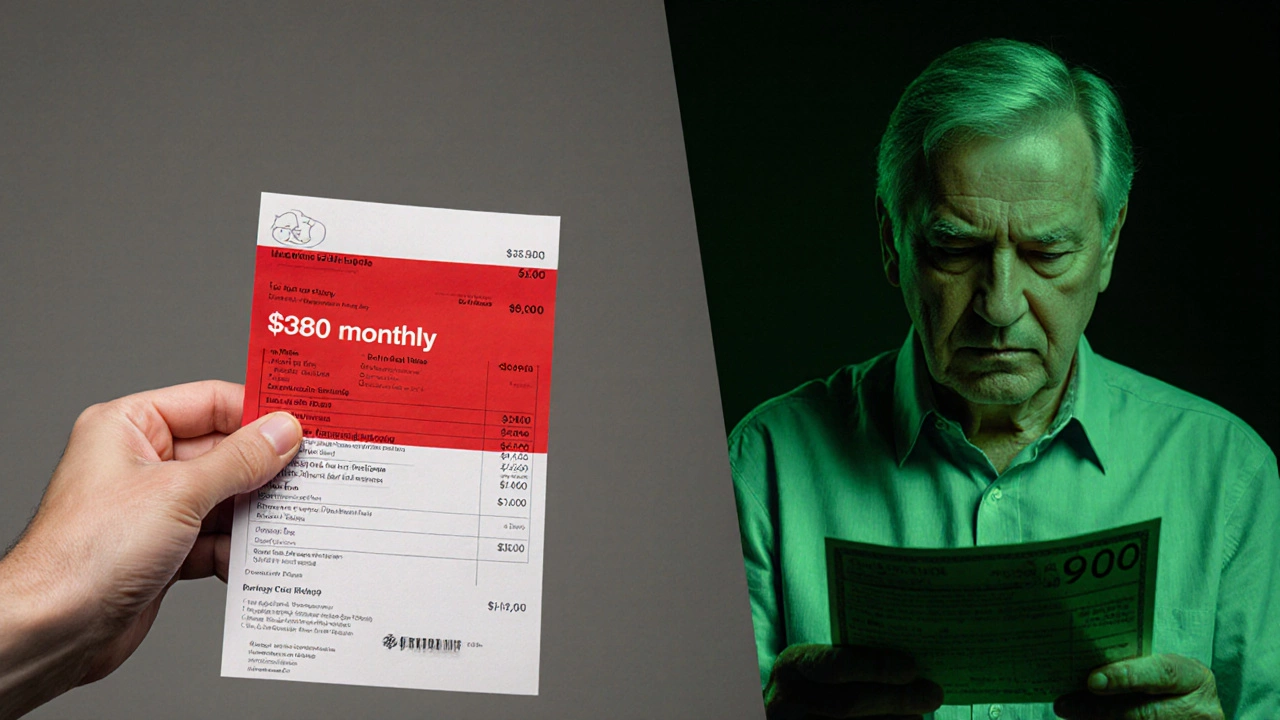

How Much Does It Cost to Buy Health Insurance on Your Own in the US?

Buying health insurance on your own in the US can cost between $300 and $900 a month, depending on your age, income, and location. Subsidies can cut costs significantly - here’s how to find the right plan without overpaying.