Oct, 31 2025

Oct, 31 2025

Health Insurance Cost Calculator

Estimate your health insurance costs based on your specific situation. Enter your details to see estimated premiums and out-of-pocket costs for different plan types.

Estimated Health Insurance Costs

Key Takeaways:

Warning:

Buying health insurance on your own in the US isn’t like signing up for a streaming service. There’s no flat monthly fee, no one-size-fits-all plan, and no clear price tag until you dig into the details. If you’re self-employed, between jobs, or just don’t get coverage through an employer, you’re on your own - and the costs can feel overwhelming. But here’s the truth: you can find affordable options if you know where to look and what to watch for.

What You’re Actually Paying For

When you buy health insurance on your own, you’re not just paying a monthly premium. You’re signing up for a system with four main costs: premiums, deductibles, copayments, and out-of-pocket maximums. Most people fixate on the monthly bill, but that’s only part of the story.For example, a plan with a $300 monthly premium might sound manageable - until you realize it has a $7,000 deductible. That means you pay the first $7,000 of medical bills yourself before insurance kicks in. Meanwhile, a $500 monthly plan might only have a $1,500 deductible. The cheaper premium isn’t always the better deal.

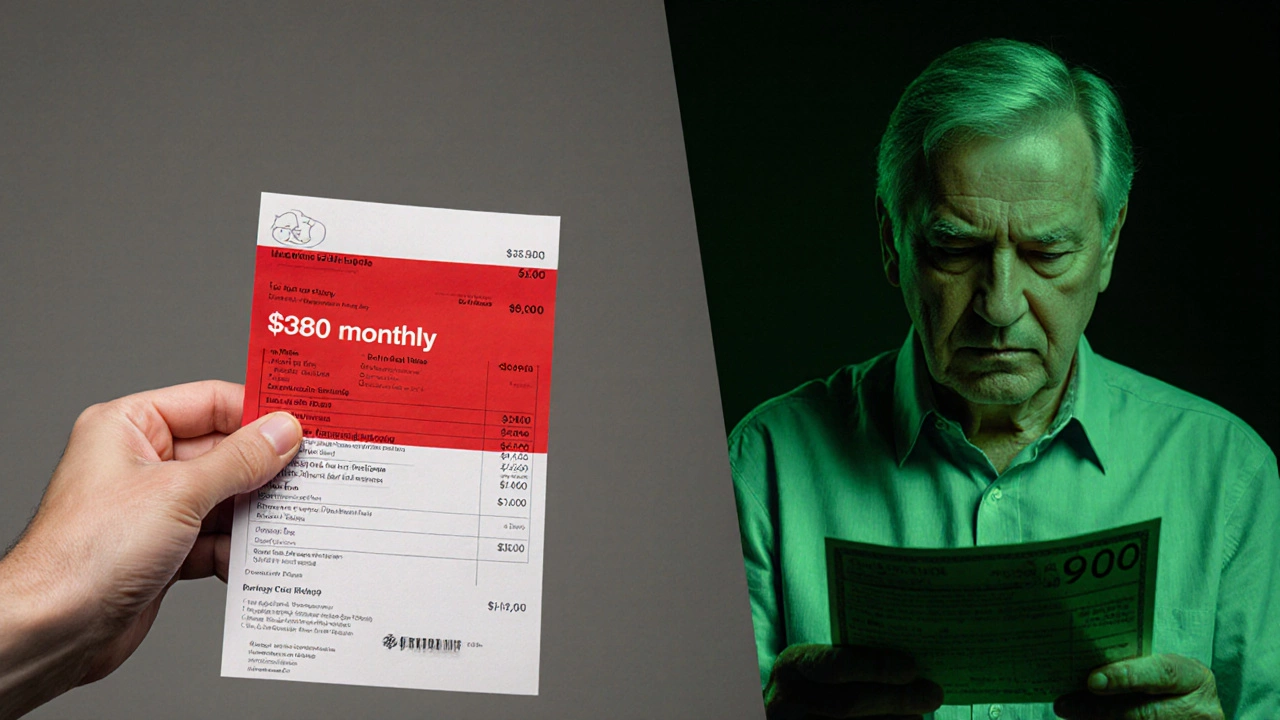

In 2025, the average monthly premium for an individual marketplace plan (without subsidies) ranges from $450 to $700. But that number jumps or drops depending on your age, location, and how much coverage you want. A 25-year-old in Texas might pay $380 for a basic plan. A 55-year-old in New York could pay $900 for the same level of coverage. Age and geography are huge factors.

Marketplace Plans vs. Off-Market Plans

Most people think they have to buy through Healthcare.gov or their state’s exchange. That’s not true - but it’s usually the smartest move. Plans sold through the Health Insurance Marketplace are the only ones eligible for federal subsidies. If your income is below 400% of the federal poverty level (about $60,000 for a single person in 2025), you could get your premium cut by 50% or more.Off-market plans - sold directly by insurers or through brokers - don’t qualify for subsidies. They sometimes look cheaper upfront, but without financial help, they often cost more over time. A broker might push you toward a $600/month off-market plan. But if you’re eligible for a $400/month subsidy on a marketplace plan, you’re saving $200 a month, or $2,400 a year. That’s not a small difference.

Plan Tiers: Bronze, Silver, Gold, Platinum

Marketplace plans are grouped into four metal tiers. Each tells you how much the plan pays vs. how much you pay:- Bronze: Pays 60% of your medical costs. You pay 40%. Lowest premiums, highest out-of-pocket costs. Best for healthy people who rarely see a doctor.

- Silver: Pays 70%. You pay 30%. Mid-range premiums and costs. Eligible for extra cost-sharing reductions if your income is low.

- Gold: Pays 80%. You pay 20%. Higher premiums, lower bills when you need care. Good for people with chronic conditions.

- Platinum: Pays 90%. You pay 10%. Highest premiums, lowest out-of-pocket. Rarely worth it unless you’re in and out of hospitals regularly.

Most people pick Silver or Gold. Bronze plans save money on premiums but can leave you with $10,000 in bills after a single hospital stay. Platinum plans cost $1,200+ a month - usually more than most people can afford, even with subsidies.

What’s Covered and What’s Not

All marketplace plans must cover ten essential health benefits:- Emergency services

- Hospitalization

- Pregnancy and newborn care

- Mental health and substance use treatment

- Prescription drugs

- Lab tests

- Preventive care (like vaccines and cancer screenings)

- Chronic disease management

- Rehabilitative services

- Pediatric services

That’s the baseline. But coverage details vary. One plan might cover all brand-name drugs. Another might require you to try cheaper generics first. One might let you see any specialist. Another requires a referral from your primary doctor.

Check the formulary (drug list) and provider network before you buy. If you take a specific medication, make sure it’s covered. If you see a therapist or specialist, confirm they’re in-network. Going out-of-network can double your costs - even on a Gold plan.

Hidden Costs and Surprises

Many people think insurance means “no more bills.” That’s a myth. You’ll still get bills - for things like:- Emergency room visits (even if you’re covered)

- Prescription co-pays ($10-$50 per fill)

- Lab work and imaging (MRI, X-rays)

- Physical therapy sessions

- Out-of-network providers

There’s also the out-of-pocket maximum - the most you’ll pay in a year for covered services. In 2025, that cap is $9,200 for an individual. Once you hit it, the insurance pays 100% for the rest of the year. But reaching that cap means you’ve already paid thousands in deductibles and co-pays.

Example: You break your leg. ER visit: $1,200. X-ray: $400. Cast and follow-ups: $800. Physical therapy: $200 per session for 12 sessions = $2,400. That’s $4,800 before insurance even starts paying. You’re halfway to your out-of-pocket max.

Who Gets the Best Deals?

If you earn less than $60,000 a year, you’re likely eligible for subsidies. The government pays part of your premium. The lower your income, the bigger the discount. Someone earning $30,000 might pay $50/month for a Silver plan. Someone earning $55,000 might pay $300.Also, if you’re under 30, you can buy a Catastrophic plan - a bare-bones option with low premiums and high deductibles ($9,200 in 2025). It only covers three primary care visits a year and protects you from huge bills if you’re in a serious accident. It’s not for routine care, but it’s better than nothing.

What Happens If You Don’t Buy Insurance?

There’s no federal penalty for being uninsured anymore - the individual mandate was removed in 2019. But that doesn’t mean you’re safe.A single hospital stay for pneumonia can cost $15,000. A broken arm? $7,500. An MRI? $1,200. Without insurance, you pay full price. Hospitals can send you to collections. Your credit score takes a hit. And if you need ongoing care - like insulin, blood pressure meds, or physical therapy - those bills add up fast.

Plus, you lose access to preventive care. No free screenings. No annual checkups. No vaccines. That means small problems become big ones - and far more expensive to fix.

How to Find the Right Plan

Here’s how to cut through the noise:- Go to Healthcare.gov or your state’s exchange. Enter your income, age, and location.

- See what subsidies you qualify for. Don’t skip this step - it changes everything.

- Filter by metal tier. If you’re healthy, start with Bronze. If you take regular meds, go Gold.

- Check the provider network. Search for your doctor, hospital, and pharmacy.

- Look at the formulary. Type in your prescriptions. If they’re not covered, move on.

- Compare total annual cost: premiums + estimated out-of-pocket (based on your usage).

Don’t just pick the cheapest monthly bill. Pick the plan that fits your life. If you never go to the doctor, a Bronze plan might save you $300 a month. If you have a child with asthma, a Gold plan might save you $5,000 a year in medication costs.

When to Buy and When to Wait

Open Enrollment runs from November 1 to January 15 each year. If you miss it, you’re stuck until next year - unless you have a qualifying life event:- Getting married

- Having a baby

- Losing employer coverage

- Moving to a new state

- Getting divorced

If you just lost your job, you can sign up within 60 days. Don’t wait. Even a short gap in coverage can leave you exposed.

Alternatives to Traditional Insurance

Some people turn to health sharing ministries or short-term plans. These aren’t insurance. They’re not regulated like insurance. They often exclude pre-existing conditions, mental health, or maternity care. They can leave you with huge bills if you get sick.Don’t be fooled by ads promising $100/month plans. If it sounds too good to be true, it is. You’re trading safety for savings - and most people end up paying more in the long run.

The only real alternative is Medicaid - if you qualify based on income. In states that expanded it, you can get full coverage for under $10/month. But eligibility varies by state. Check your state’s rules.

Final Reality Check

Buying health insurance on your own isn’t easy. But it’s necessary. The average American spends $7,000 a year on health care - even with insurance. Without it? You’re looking at $15,000-$50,000 for a single serious illness.The goal isn’t to find the cheapest plan. It’s to find the one that protects you when it matters most. A $500/month plan with a $1,500 deductible might cost more upfront - but it could save you $20,000 if you need surgery. That’s not a gamble. That’s smart planning.

Use the marketplace. Check your subsidies. Compare networks. Read the fine print. You don’t need to be an expert - just careful. Your future self will thank you.

Can I buy health insurance anytime of the year?

No, not unless you have a qualifying life event like losing a job, getting married, or having a baby. Outside of those events, you can only enroll during Open Enrollment, which runs from November 1 to January 15 each year. Missing it means waiting until next year - unless you qualify for Medicaid or another public program.

Are subsidies available for everyone?

No. Subsidies are only available to people with incomes between 100% and 400% of the federal poverty level. In 2025, that’s about $14,580 to $60,000 for a single person. If you earn more than that, you won’t get premium help. But you can still buy a plan on the marketplace - you just pay full price.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay before your insurance starts sharing costs. Your out-of-pocket maximum is the most you’ll pay in a year for covered services - including deductibles, copays, and coinsurance. Once you hit that cap, your plan pays 100% for the rest of the year. For example, if your deductible is $2,000 and your out-of-pocket max is $8,000, you’ll pay up to $8,000 total before insurance covers everything.

Can I use my health insurance out of state?

Emergency care is always covered, no matter where you are. For non-emergency care, it depends on your plan’s network. Most plans only cover providers in your home state. If you travel frequently or live part-time in another state, look for a plan with a national network or consider a high-deductible plan paired with an HSA for flexibility.

Is it better to get a high-deductible plan with an HSA?

It can be - if you’re healthy and want to save money long-term. Health Savings Accounts (HSAs) let you put pre-tax money aside to pay for medical expenses. In 2025, you can contribute up to $4,300 per year. The money rolls over, earns interest, and can be used for retirement health costs. But only high-deductible plans (minimum $1,650 deductible in 2025) qualify. If you expect to use a lot of care, a lower-deductible plan may be safer.