Healthcare Insurance UK: What You Need to Know in 2025

If you’re scrolling through your inbox and see another email about health cover, you might wonder whether it’s worth paying extra when the NHS already exists. In plain terms, UK healthcare insurance is a way to speed up access, get private rooms, and choose specialists without waiting months. Below we break down the basics, compare private and NHS options, and give you a quick cost cheat‑sheet.

Private vs NHS – When Private Makes Sense

The NHS provides free emergency care and most routine treatment, but you can face long waiting lists for elective surgery, physiotherapy, or specialist appointments. Private health insurance steps in when you need faster treatment, want a choice of hospital, or prefer a single‑room stay. Many people use private cover just for specific procedures – like a knee replacement – while still using the NHS for everyday checks.

For example, our article “Private Healthcare vs NHS: Which Is Better for UK Patients?” shows that private patients usually see a consultant within weeks instead of months. If you have a busy schedule, a private appointment can be booked quickly, freeing you from the uncertainty of waiting lists.

How Much Does Private Health Insurance Cost in 2025?

Prices vary by age, location, and level of cover. In 2025 the average monthly premium for a single adult ranges from £60 to £120 for basic plans, while comprehensive policies can hit £200 or more. Families pay roughly £150‑£300 per month for a decent package that includes dental and optical add‑ons. Our piece “Private Health Insurance UK Monthly Cost: What to Expect in 2025” breaks down real‑world examples, so you can see how a 30‑year‑old in London compares to a 55‑year‑old in Manchester.

Factors that push the price up include: pre‑existing conditions, opting for a higher reimbursement level, and adding extras like mental‑health counselling. If you’re healthy and only need occasional private scans, a low‑tier plan can save you money while still giving you the speed you want.

When shopping for a policy, start by asking yourself three questions: Do I need fast access to elective surgery? Am I after private hospital rooms? Do I want extra benefits such as dental, vision, or fitness services? Your answers will point you toward a plan that fits your budget without paying for unused features.

Several insurers dominate the market in 2025 – Bupa, AXA, and Vitality – each with a slightly different focus. Bupa leans heavily on hospital networks, AXA offers flexible add‑ons, and Vitality rewards healthy lifestyle habits with lower premiums. Our guide “Best Health Insurance Companies 2025: Honest Guide to Top Providers” walks you through each provider’s strengths, so you can match them to your priorities.

Don’t forget to check if your employer already offers a group policy. Many UK firms negotiate bulk rates that are cheaper than individual plans, and the coverage often includes family members at no extra cost.

Finally, keep an eye on the fine print. Some policies have a waiting period of 30‑90 days before certain conditions are covered. If you’re planning surgery soon, make sure the waiting period aligns with your timeline.

In short, UK healthcare insurance isn’t a one‑size‑fits‑all product. By knowing the cost ranges, understanding the private vs NHS trade‑offs, and focusing on the benefits you truly need, you can pick a plan that speeds up care without breaking the bank.

What Country Is #1 in Healthcare? The Real Leader in Healthcare Insurance and Outcomes

The UK ranks #1 in global healthcare for its universal, tax-funded system that delivers better outcomes at half the cost of the U.S. No one goes broke paying for care, and access is based on need-not income.

Is UK healthcare completely free? Here's what you actually pay for

The NHS provides free healthcare at the point of use, but prescriptions, dental care, and eye tests cost money in England. Learn what's truly free and where you'll still pay out of pocket.

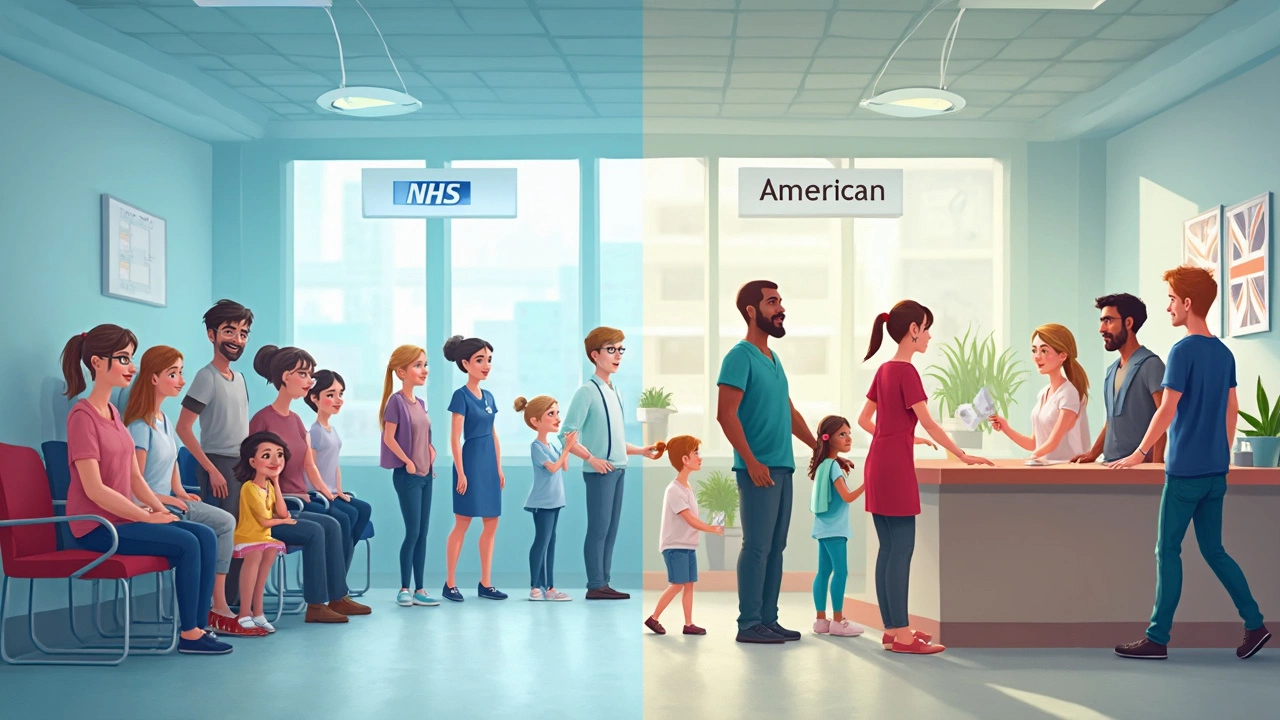

US vs UK Healthcare: Which System Works Better for You?

Figuring out whether the US or UK healthcare system is better isn't as simple as it sounds, especially if you care about costs, waiting times, and access to care. This article breaks down how each country handles insurance, doctor visits, emergencies, and the fine print that could mess with your wallet or your sanity. We’ll look at what it actually feels like to use the NHS versus American private insurance. Plus, you’ll get tips on what to watch out for if you’re moving or traveling between the two. It’s everything you need to know about picking the system that really works for you and your family.

Is Surgery Free in the UK? What You Need to Know About Healthcare and Costs

Wondering if surgery is really free in the UK? This article uncovers how the NHS covers surgery, where private care fits in, and what exceptions exist. Find out how residency and certain life situations affect your access and what costs might surprise you. Learn about waiting times, hidden fees, and insurance tips. Get straightforward advice on making the best choice for your health without worrying about your budget.

Understanding the Costs of Healthcare in the UK: What Citizens Pay

The UK healthcare system, primarily through the NHS, offers many services without direct charges for citizens, funded predominantly by taxation. However, there are specific areas where individuals incur costs, such as dental services, prescriptions, and certain elective procedures. This article delves into the nuances of what UK citizens typically pay for their healthcare and offers insights into optional health insurance policies. It also provides tips for managing these costs effectively.