Health Insurance Premiums: What You Pay and Why It Matters

When you pay your health insurance premiums, the regular payments you make to keep your private health coverage active. Also known as insurance dues, these are the upfront cost of accessing faster treatment, private rooms, or specialist appointments outside the NHS. But what you pay each month doesn’t guarantee you’ll get what you need—especially when coverage gaps, age limits, or hidden exclusions kick in.

Health insurance premiums are tied directly to private health insurance, a system where individuals or employers pay for medical services beyond what the NHS provides. The more comprehensive the plan—covering dental, mental health, or cosmetic procedures—the higher the premium. And it’s not just about cost. A 2023 study by the King’s Fund found that people paying over £3,000 a year for private insurance were twice as likely to skip NHS waiting lists for joint replacements or eye surgery. But here’s the catch: if you lose your job or turn 26, your coverage might vanish overnight, as shown in posts about health insurance coverage, the specific treatments and services your plan actually pays for. Many don’t realize their premium doesn’t cover everything—like top surgery, dental implants, or nerve pain therapies—unless explicitly listed.

That’s why comparing premiums isn’t just about price. It’s about what’s included, who’s eligible, and how long it lasts. The UK’s system leaves many caught between the NHS and private care, especially when costs for procedures like tummy tucks or facelifts skyrocket abroad. Some pay high premiums only to find their plan won’t cover the very treatment they need. Others avoid premiums altogether, relying on the NHS, but face long waits that can turn manageable pain into chronic suffering. The real question isn’t just ‘How much do I pay?’ but ‘What am I really buying?’

Below, you’ll find real breakdowns of what these premiums actually cover, who gets left out, and how people in the UK are finding cheaper, smarter ways to manage their health—whether they’re paying monthly or trying to avoid the system entirely.

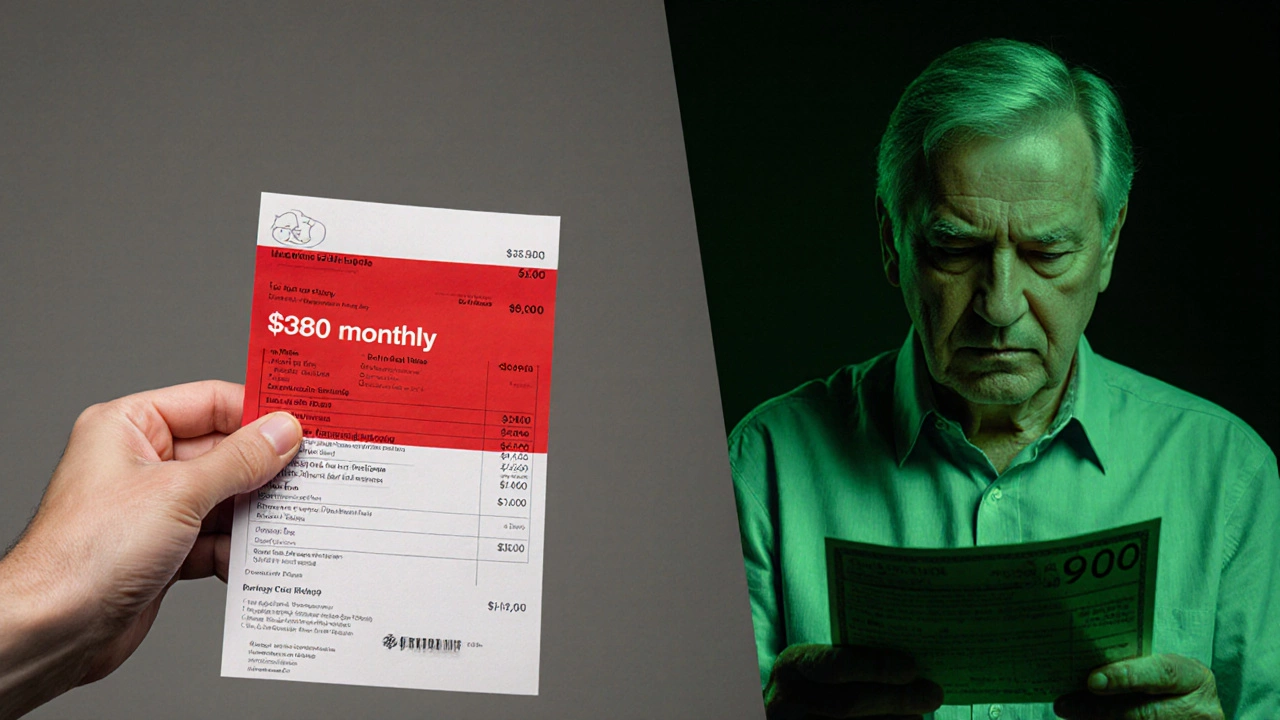

How Much Does It Cost to Buy Health Insurance on Your Own in the US?

Buying health insurance on your own in the US can cost between $300 and $900 a month, depending on your age, income, and location. Subsidies can cut costs significantly - here’s how to find the right plan without overpaying.