Dependent Insurance Age: When Coverage Ends and What Comes Next

When you're covered under a parent's health insurance, a plan that extends coverage to family members under specific conditions. Also known as dependent coverage, it's a critical safety net for young adults, students, and others who aren't yet financially independent. But that safety net doesn't last forever. In the UK and most private insurance systems, dependent insurance age typically ends at 25 — though some plans extend it to 26 if the dependent is in full-time education. This isn't a universal rule, though. It changes based on the insurer, the type of policy, and whether it's tied to an employer or bought privately.

Many people assume that turning 18 means losing coverage, but that's not true. Most insurers allow dependents to stay on the plan until 25, even if they're working, living on their own, or no longer in school. The real trigger is often the insurance policy terms, the specific rules written into the contract by the provider. Some plans require proof of enrollment in college or university to extend coverage past 21. Others don’t care — they just care about age. And if you're on a parent’s employer-sponsored plan, federal and UK regulations may influence the cutoff. For example, while the US allows coverage until 26 under the ACA, the UK doesn’t have a federal mandate — so it’s entirely up to the insurer. That’s why checking your policy document is non-negotiable.

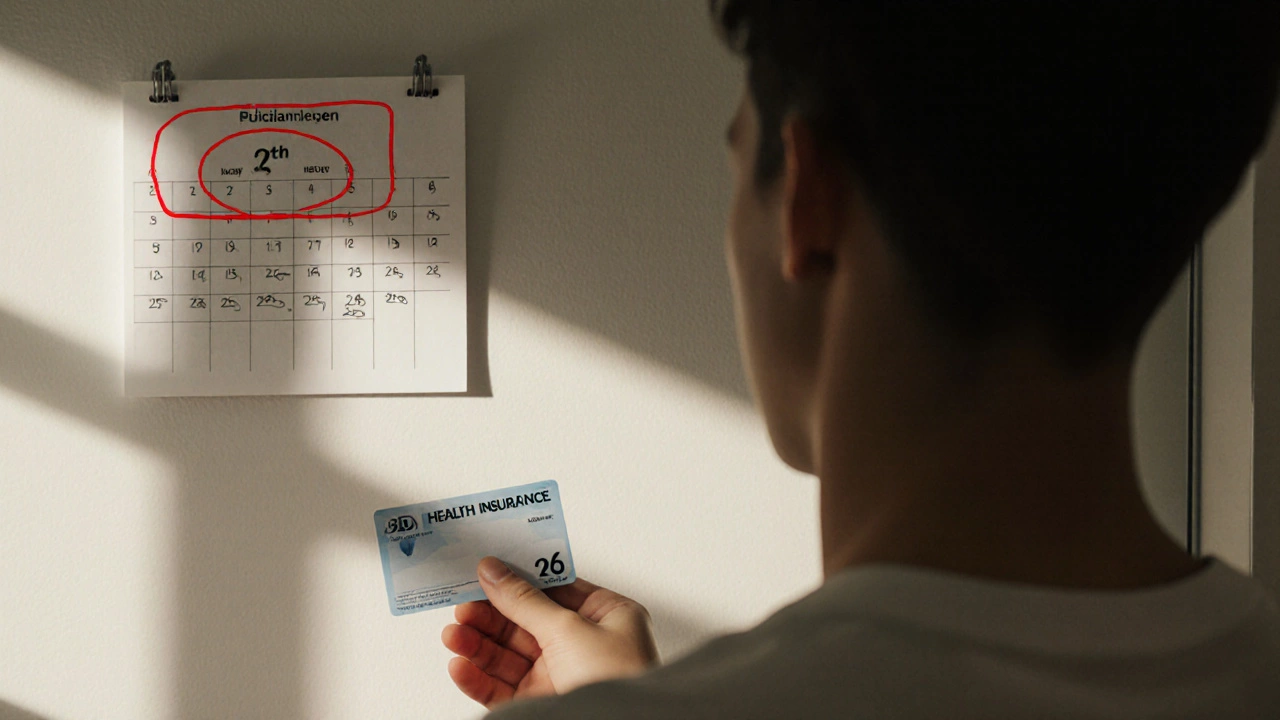

When the clock hits the cutoff, you’re not left without options. You can switch to an individual plan, join a workplace scheme if you’re employed, or apply for NHS coverage if you’re a UK resident. Some insurers offer transition plans or grace periods — but you have to ask. Many people miss this window because they assume coverage continues automatically. It doesn’t. And if you go without insurance for even a few months, you could face high out-of-pocket costs for something as simple as an emergency visit or a prescription.

There’s also the issue of mental health coverage, a key benefit often included in family plans but sometimes limited or excluded in individual policies. If you’ve been relying on your parent’s plan for therapy or medication, losing that coverage can be disruptive. That’s why it’s smart to start planning six months before the cutoff. Talk to your insurer. Compare individual plans. Look into NHS eligibility. Don’t wait until the last minute.

The posts below cover real situations where people lost coverage unexpectedly, how to fight an insurer’s decision, and what alternatives actually work. You’ll find guides on switching plans, negotiating with insurers, and understanding what’s covered under NHS care when private insurance ends. Whether you’re turning 25 next month or helping a child plan ahead, these stories give you the facts — no fluff, no jargon, just what you need to know to keep yourself or your loved ones protected.

What Age Do You Lose Insurance Coverage? Private Health Rules Explained

Most private health insurance plans stop covering you at age 26. Learn when coverage ends, what options you have after, and how to avoid being left uninsured.