Buy Health Insurance US: What You Need to Know Before You Sign Up

When you buy health insurance US, you’re not just picking a plan—you’re deciding how you’ll handle medical bills, doctor visits, and emergencies. This isn’t like buying a phone plan. It’s about your body, your money, and your peace of mind. Health insurance, a financial safety net that covers part or all of medical expenses in exchange for regular payments. Also known as private health insurance, it’s the main way most Americans access care outside of Medicare or Medicaid. And if you’re shopping for it, you’re probably overwhelmed. That’s normal. The system is complex, prices vary wildly, and not all plans are created equal.

When you buy health insurance US, a financial safety net that covers part or all of medical expenses in exchange for regular payments. Also known as private health insurance, it’s the main way most Americans access care outside of Medicare or Medicaid. You’re not just paying for doctor visits—you’re paying for access to hospitals, prescriptions, labs, and sometimes even mental health services. But here’s the catch: a low monthly premium doesn’t mean low costs. You might get stuck with a $10,000 deductible, or find your favorite doctor isn’t in-network. US healthcare system a fragmented, cost-heavy structure where private insurers, hospitals, and providers operate independently, often leading to high out-of-pocket expenses. That’s why people end up paying more out of pocket than they expected—even with insurance. And if you’re young and healthy, you might think you don’t need it. But one accident or sudden illness can wipe out your savings. That’s why even basic coverage matters.

What you get depends on where you live, your income, your job, and whether you qualify for subsidies. Some plans cover preventive care for free. Others don’t cover birth control, mental health visits, or physical therapy unless you jump through hoops. health coverage options the range of plans available, including employer-sponsored, marketplace, Medicaid, Medicare, and short-term policies. You’ve got employer plans, marketplace plans, Medicaid if you qualify, Medicare if you’re over 65, and short-term plans that sound cheap but often exclude the things you actually need. And if you’re self-employed or between jobs? You’re on your own. That’s where the real confusion starts.

People who’ve been through it say the biggest mistake is choosing the cheapest monthly payment without checking the fine print. A plan with a $200 premium might cost you $8,000 if you need surgery. Another might have a $1,000 deductible but cover 80% of prescriptions. You need to look at the whole picture: premium, deductible, copay, out-of-pocket max, and network. And don’t assume your doctor is in-network—call and confirm. Most people don’t.

Below, you’ll find real breakdowns of what’s actually covered, how much things cost compared to other countries, when coverage ends, and how people manage to afford care without going broke. No fluff. Just what works—and what doesn’t—when you’re trying to buy health insurance in the US.

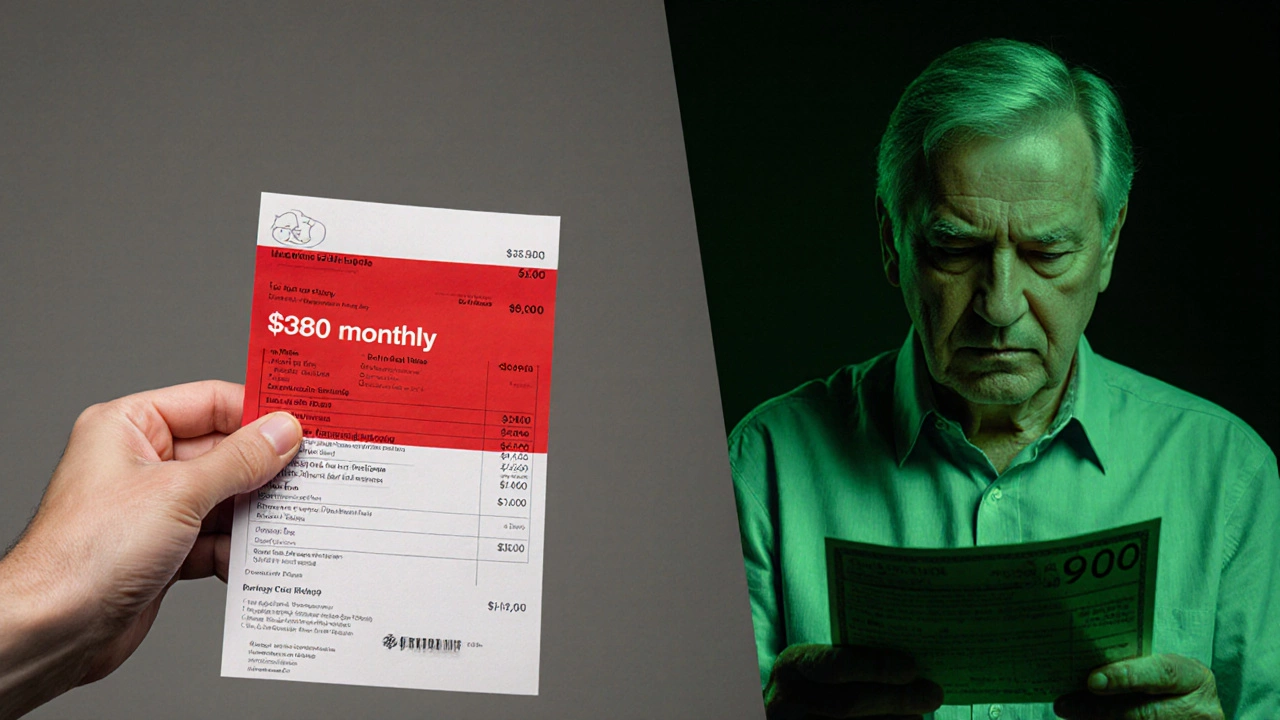

How Much Does It Cost to Buy Health Insurance on Your Own in the US?

Buying health insurance on your own in the US can cost between $300 and $900 a month, depending on your age, income, and location. Subsidies can cut costs significantly - here’s how to find the right plan without overpaying.