Dec, 21 2025

Dec, 21 2025

Medicare Part D Cost Calculator

Estimate Your Prescription Costs

$0.00

Monthly prescription cost

Many people assume everyone pays the same amount for Medicare prescriptions-like that $170 figure floating around online. But that number isn’t a flat fee. It’s a myth. The truth? Your out-of-pocket cost for a prescription under Medicare depends on your plan, your income, where you live, and even which pharmacy you use.

Where Does the $170 Number Come From?

The $170 figure usually refers to the Part D monthly premium for the most expensive Medicare prescription drug plans in 2025. But that’s not what most people pay. In fact, the national average monthly premium for a standard Part D plan in 2025 is just $34. Some plans cost as little as $0. Others go over $100. The $170 is the top end-reserved for people with high incomes or those enrolled in plans with extra benefits like coverage for brand-name drugs or low deductibles.

Medicare doesn’t set one price for prescriptions. Instead, it lets private insurance companies design their own drug plans. Each plan has its own list of covered drugs (called a formulary), its own pharmacy network, and its own cost structure. So if you’re paying $170 a month, you’re likely on a plan with extra perks-or you’re paying extra because your income is above the threshold.

How Medicare Part D Costs Really Work

There are five stages to how you pay for prescriptions under Medicare Part D:

- Deductible - Some plans charge up to $505 in 2025 before coverage starts. Others have no deductible at all.

- Coverage phase - After you meet the deductible, you pay a copay or coinsurance. For generic drugs, that’s often $5-$15. For brand-name drugs, it could be 25% of the cost.

- Coverage gap (donut hole) - Once you and your plan have spent $5,030 on drugs in 2025, you enter the gap. You pay 25% of the cost for both brand-name and generic drugs during this phase.

- Catastrophic coverage - After you’ve spent $8,000 out-of-pocket, you pay either 5% of the drug cost or a small copay ($4.50 for generics, $11.20 for brand-name), whichever is higher.

- Extra Help - If your income is below $21,590 (individual) or $29,170 (couple) in 2025, you may qualify for government help that cuts your premiums, deductibles, and copays to nearly zero.

So if you’re on a low income, you might pay $0 for your prescriptions. If you’re on a high-income plan with no deductible and brand-name coverage, you could be paying close to $170 a month in premiums alone-plus your copays on top.

Income-Related Monthly Adjustment Amount (IRMAA)

If you earn more than $106,000 as an individual or $212,000 as a couple (based on your 2023 tax return), you pay extra for your Medicare Part B and Part D premiums. This is called IRMAA. For Part D, the extra charge can add $12.60 to $77.90 per month on top of your plan’s base premium.

So someone making $150,000 a year might pay $40 for their plan’s base premium, then another $45 in IRMAA. That’s $85 before they even pick up a prescription. Add a $50 monthly copay for a specialty drug, and suddenly you’re spending $135 a month-not $170, but still far from what most people pay.

Pharmacy Choice Matters More Than You Think

Your out-of-pocket cost isn’t just about your plan. It’s also about where you fill your prescription. Medicare Part D plans have preferred pharmacies-usually big chains like CVS, Walgreens, or Walmart. If you use one of those, your copay might be $10 for a generic. If you go to a non-preferred pharmacy, that same drug could cost $45.

Walmart and Kroger offer many generic drugs for under $10, even without insurance. But if you’re on Medicare and don’t know your plan’s preferred network, you could be overpaying by hundreds of dollars a year. Always check your plan’s pharmacy directory before filling a new prescription.

Brand-Name vs. Generic Drugs

Many people assume brand-name drugs are the only option. They’re not. In most cases, a generic version exists and works just as well. For example, the brand-name drug Lisinopril costs $70 a month. The generic? $5. That’s a 93% savings.

Medicare plans often place generics in the lowest cost tier. Brand-name drugs, especially newer ones, are in higher tiers with higher copays. If your doctor prescribes a brand-name drug, ask if there’s a generic alternative. Most do.

Even if your plan doesn’t cover a generic, you can still pay cash at Walmart or Costco. Sometimes, paying cash is cheaper than using your insurance.

What You Can Do to Lower Your Costs

You’re not stuck with whatever you’re paying now. Here’s how to reduce your prescription costs:

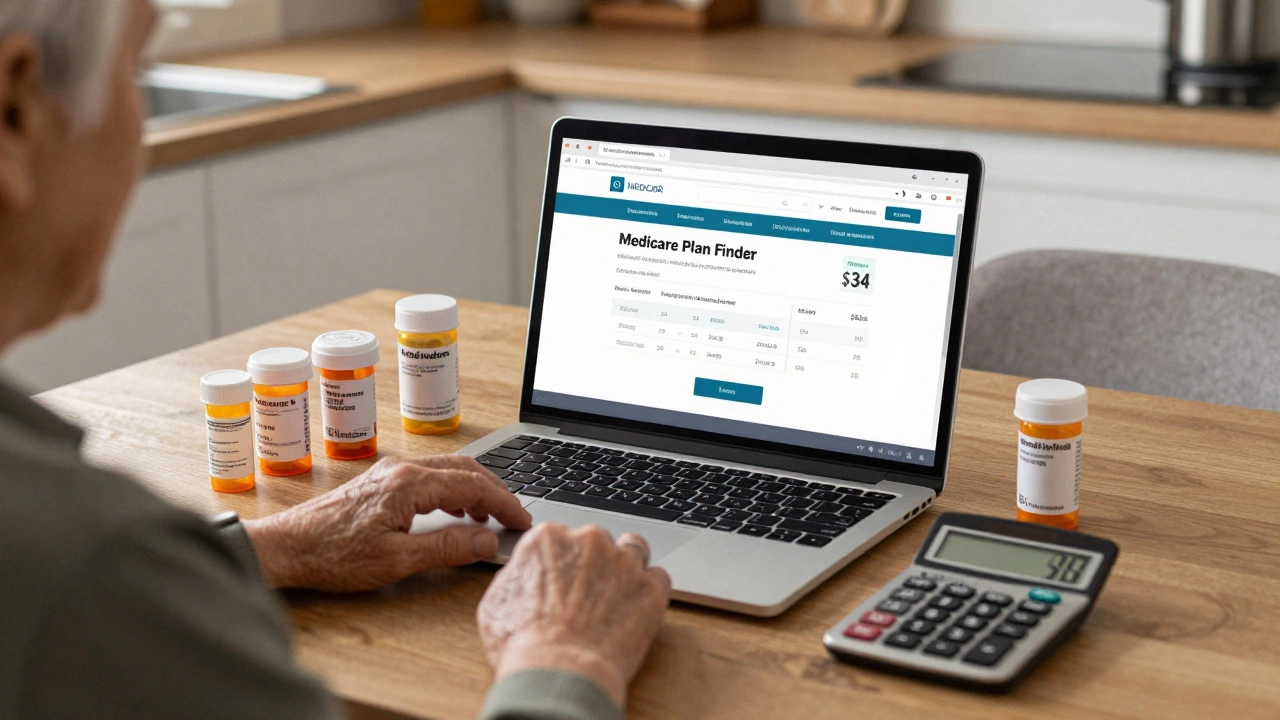

- Review your plan every year - Medicare’s Part D plans change every January. What was cheap last year might be expensive this year. Use the Medicare Plan Finder tool to compare plans based on your exact medications.

- Apply for Extra Help - If you’re on a fixed income, you may qualify for federal assistance that covers premiums, deductibles, and copays. Apply at SSA.gov or call 1-800-MEDICARE.

- Ask for samples - Your doctor may have free samples of new prescriptions. This can help you test a drug before paying full price.

- Use mail-order pharmacies - Many plans offer 90-day supplies through mail-order for the same price as a 30-day retail fill. That’s two fewer trips and lower costs.

- Check drug discount cards - Programs like GoodRx or SingleCare can give you discounts even if you have Medicare. Sometimes, they’re cheaper than your plan’s copay.

Myths vs. Reality

Let’s clear up a few common misunderstandings:

- Myth: Everyone pays $170 for Medicare prescriptions. Reality: Less than 5% of enrollees pay that much in premiums alone. Most pay under $50 total per month.

- Myth: Medicare covers all drugs. Reality: Many drugs, especially weight-loss meds, fertility drugs, and some mental health drugs, are excluded or restricted.

- Myth: Once you’re in the donut hole, you pay nothing. Reality: You still pay 25% of the cost-just less than before.

- Myth: You can’t switch plans after enrollment. Reality: You can switch during the Annual Enrollment Period (October 15-December 7) or during Special Enrollment Periods if your circumstances change.

What If You Can’t Afford Your Medications?

If you’re skipping doses or splitting pills because you can’t pay, you’re not alone. One in four Medicare beneficiaries says they’ve cut back on meds due to cost.

Here’s what to do:

- Ask your pharmacist if there’s a lower-cost alternative.

- Call your drug manufacturer-they often have patient assistance programs.

- Check with local nonprofits or community health centers. Some offer free or discounted prescriptions.

- Apply for Extra Help immediately. It can be retroactive up to 12 months.

Medicare isn’t designed to leave people behind. But you have to know how to use it. Don’t assume the system will help you automatically. You need to act.

Final Thoughts

No, not everyone pays $170 for Medicare. That number is a red herring. It’s the peak, not the average. Most people pay far less-sometimes nothing. But if you’re on a high-income plan, use expensive drugs, or don’t shop around, you could easily end up paying close to that amount.

The key isn’t guessing. It’s checking. Review your plan. Compare prices. Ask questions. Use tools like Medicare’s Plan Finder. Apply for help if you qualify. Your wallet-and your health-will thank you.

Do all Medicare Part D plans cost $170 per month?

No. The $170 figure is the highest monthly premium for some specialized plans in 2025. The national average is $34. Many plans cost $0, and others range from $15 to $100. Only people with high incomes or those on premium plans pay close to $170.

Why do some people pay more than others for the same drug?

Three reasons: their plan’s formulary, their pharmacy network, and their income. A drug might cost $5 at Walmart with a preferred plan, $45 at a non-preferred pharmacy, or $100 if it’s a brand-name drug with no generic. Higher-income enrollees also pay extra through IRMAA.

Can I switch Medicare Part D plans anytime?

You can switch during the Annual Enrollment Period (October 15 to December 7) each year. You can also switch during a Special Enrollment Period if you move, lose other coverage, or qualify for Extra Help. Outside these times, you’re locked in.

Is there help for people with low income?

Yes. The Extra Help program reduces or eliminates Part D premiums, deductibles, and copays. In 2025, individuals earning under $21,590 and couples under $29,170 qualify. Apply at SSA.gov or call 1-800-MEDICARE. It’s free and can be retroactive.

Should I always use my Medicare Part D plan to fill prescriptions?

Not always. Sometimes paying cash at Walmart, Costco, or using a discount card like GoodRx is cheaper than your plan’s copay-especially for generics. Always compare the cash price with your plan’s cost before paying.