US Medical Bills – What You Need to Know

When dealing with US medical bills, the charges you receive for healthcare services in the United States, including hospital fees, physician fees, and prescription costsAmerican medical expenses, it’s easy to feel overwhelmed. US medical bills are a collection of line‑item costs that add up fast, especially if you’re not covered by a robust insurance plan. They include everything from emergency room visits to routine lab tests, and each item follows its own pricing rules.

Key Factors That Drive US Medical Bills

One major player in the cost puzzle is private health insurance, a policy that helps offset the high price tags on doctor visits, surgeries, and prescriptions in the US. Without it, patients often face the full list price, which can be several times higher than the negotiated rates insurers get. Another factor is NHS charges for visitors, the fees that foreign travelers may incur when they seek care in the United Kingdom’s public health system. While the NHS offers free care for residents, visitors can be billed for services, and those bills can be influenced by US‑based insurance policies if they have international coverage.

Understanding US medical bills also means looking at medical tourism costs. Many patients travel abroad to avoid the steep prices at home, but the savings can be offset by travel expenses, follow‑up care, and potential complications. The equation looks like this: US medical bills = hospital fees + physician fees + prescription costs + facility charges. Each component is a separate entity that contributes to the total, and knowing how they interact helps you predict the final amount. For example, a simple outpatient visit might be $150, but add a lab test and you’re quickly over $300.

Another layer is the role of billing transparency. Unlike many countries where prices are posted openly, US providers often give vague estimates. That lack of clarity fuels surprise bills and makes budgeting tough. Patients who shop around for prices, ask for itemized statements, and negotiate with providers tend to end up with lower totals. This practice demonstrates the semantic link: knowledge of insurance coverage influences the ability to manage US medical bills. When you know which services are covered, you can avoid out‑of‑pocket surprises.

Finally, the timing of payments matters. Some plans settle with providers directly, while others require patients to pay up front and seek reimbursement later. This timing gap can affect cash flow and stress levels. As you read through the articles below, you’ll see real‑world examples of how visitors navigate NHS charges, how private insurers negotiate rates, and why medical tourism is both a solution and a risk. Armed with these insights, you’ll be better prepared to handle any bill that lands on your doorstep.

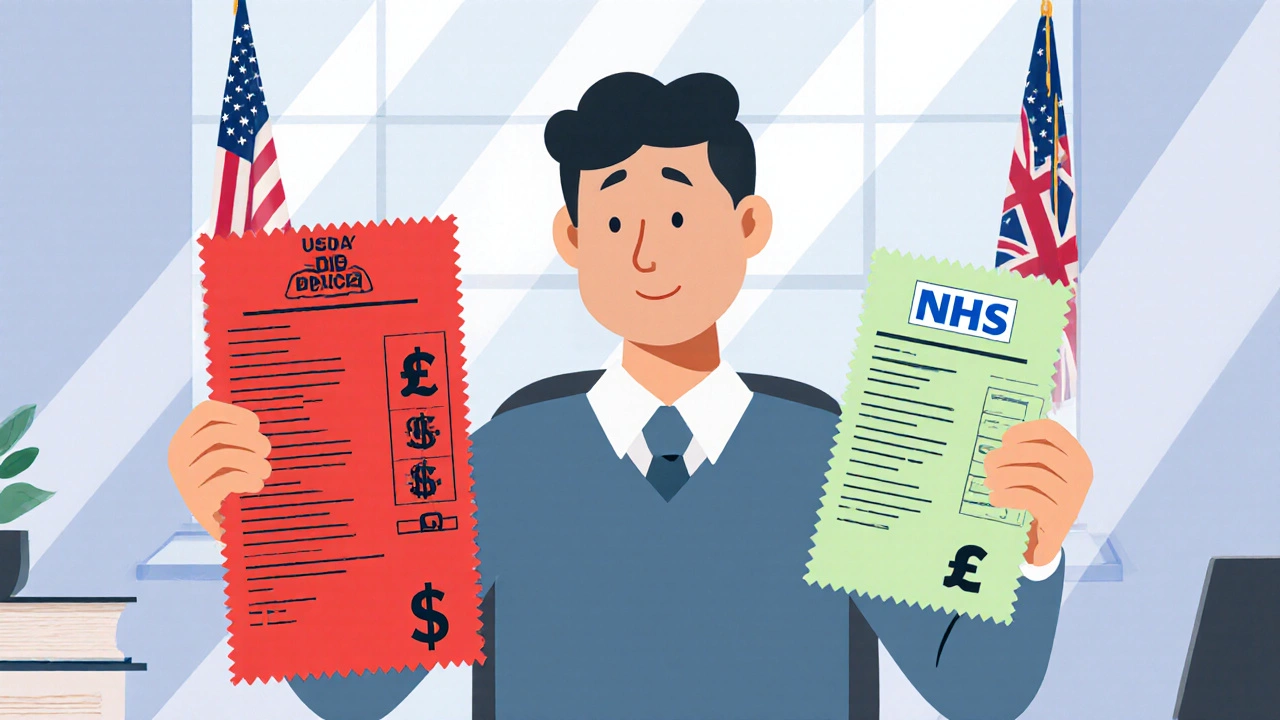

Is Healthcare More Expensive in the US or the UK? A Detailed Cost Comparison

A detailed comparison shows the US spends about 2.5x more on healthcare than the UK across primary care, hospital stays, prescriptions, and out‑of‑pocket costs.