Healthcare Costs US – A Clear Guide

When navigating Healthcare costs US, the total amount spent on medical services, drugs, and insurance in the United States, you quickly see that the bill isn’t just one line. It includes medical insurance premiums, the monthly or annual fees you pay to keep coverage active, out‑of‑pocket expenses, the cash you pay at the pharmacy or clinic after insurance, and prescription drug prices, the cost of each medication before any discount. Understanding how each piece fits together helps you plan smarter and avoid surprise bills.

Key Factors Driving US Healthcare Costs

Healthcare costs US have risen faster than inflation for the past decade, and three forces sit at the core of that climb. First, medical insurance premiums, the regular payments that keep policies active directly boost the amount families spend each month. Second, the structure of out‑of‑pocket expenses, deductibles, copays and coinsurance that patients must cover before insurance kicks in forces many to delay care or shop around for cheaper options. Third, prescription drug prices, the list price set by manufacturers before rebates or coupons can dwarf the cost of the same treatment in other countries. Together, these elements form a cascade: Healthcare costs US encompass medical insurance premiums, out‑of‑pocket expenses, and prescription drug prices.

The relationship between insurance premiums and overall affordability is straightforward: higher premiums raise the baseline spend for every subscriber, which in turn squeezes disposable income for other health needs. Medical insurance premiums influence the overall affordability of care. When premiums climb, employers may shift more cost onto employees through higher deductibles, creating a feedback loop that pushes up out‑of‑pocket spending.

Out‑of‑pocket expenses are the most visible part of the bill for most patients. A typical plan might require a $1,500 deductible, a $30 copay for a primary‑care visit, and a 20% coinsurance for specialist care. Those numbers add up quickly, especially for chronic conditions that need ongoing labs or therapy. Out‑of‑pocket expenses drive patient decisions on whether to seek treatment. Understanding your plan’s cost‑sharing rules can help you schedule preventive visits before you hit a high deductible, potentially saving hundreds of dollars.

Prescription drug prices have become a headline‑grabbing issue because they affect everyone from seniors on Medicare to parents buying antibiotics for kids. Brand‑name drugs can cost three to five times more than their generic equivalents, and pharmacy benefit managers often negotiate rebates that aren’t visible to the consumer. When you compare the same medication across pharmacies, you might see a price swing of $10 to $80 per prescription. Knowing how to use discount cards, compare prices online, or ask your doctor about a therapeutic alternative can lower that line item dramatically.

Finally, hospital billing, the detailed invoice that lists every service, test, and room charge during a stay adds another layer of complexity. Charges for a simple office visit can balloon when coded procedures, facility fees, and ancillary services are bundled together. Surprise bills often arise when an out‑of‑network specialist is involved or when emergency care is provided at a high‑cost hospital. Patients can negotiate bills, request itemized statements, or use financial assistance programs to trim the final amount.

Armed with this overview, you’ll be better prepared to dive into the specific articles below. They break down each piece of the puzzle, offer actionable tips, and point out where you can save money without sacrificing care.

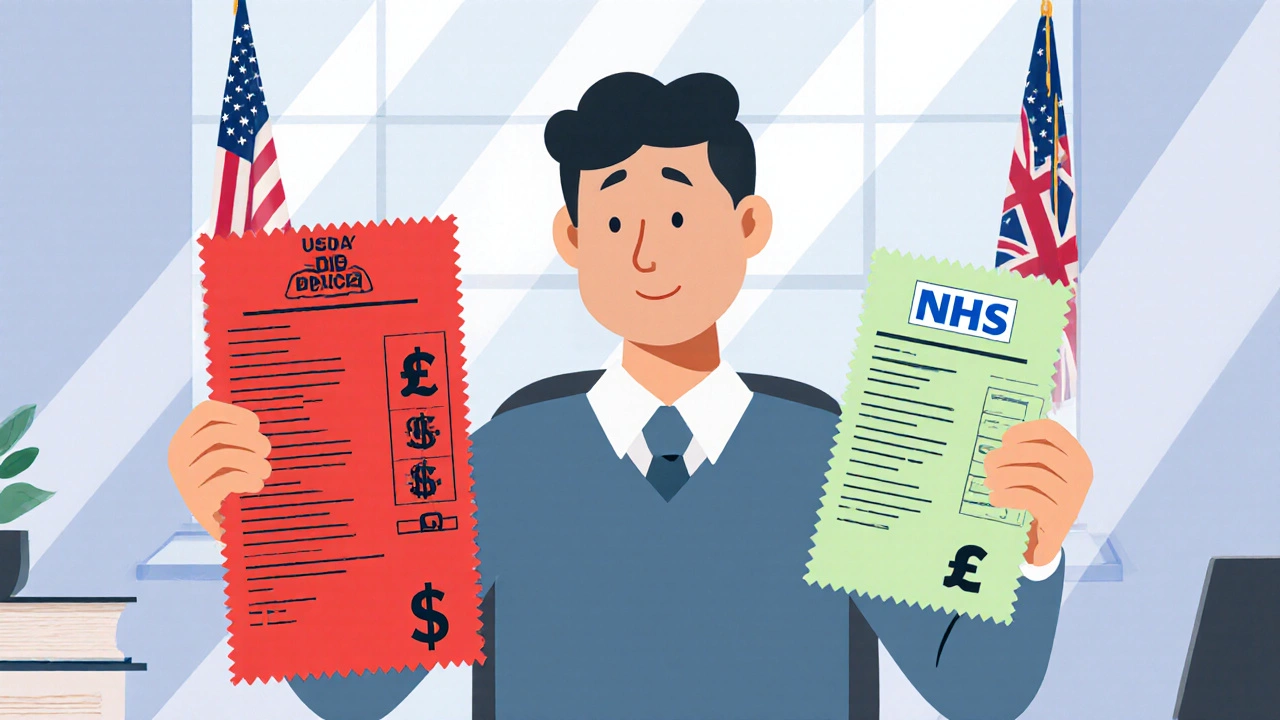

Is Healthcare More Expensive in the US or the UK? A Detailed Cost Comparison

A detailed comparison shows the US spends about 2.5x more on healthcare than the UK across primary care, hospital stays, prescriptions, and out‑of‑pocket costs.