Health Insurance for Top Surgery – What You Need to Know

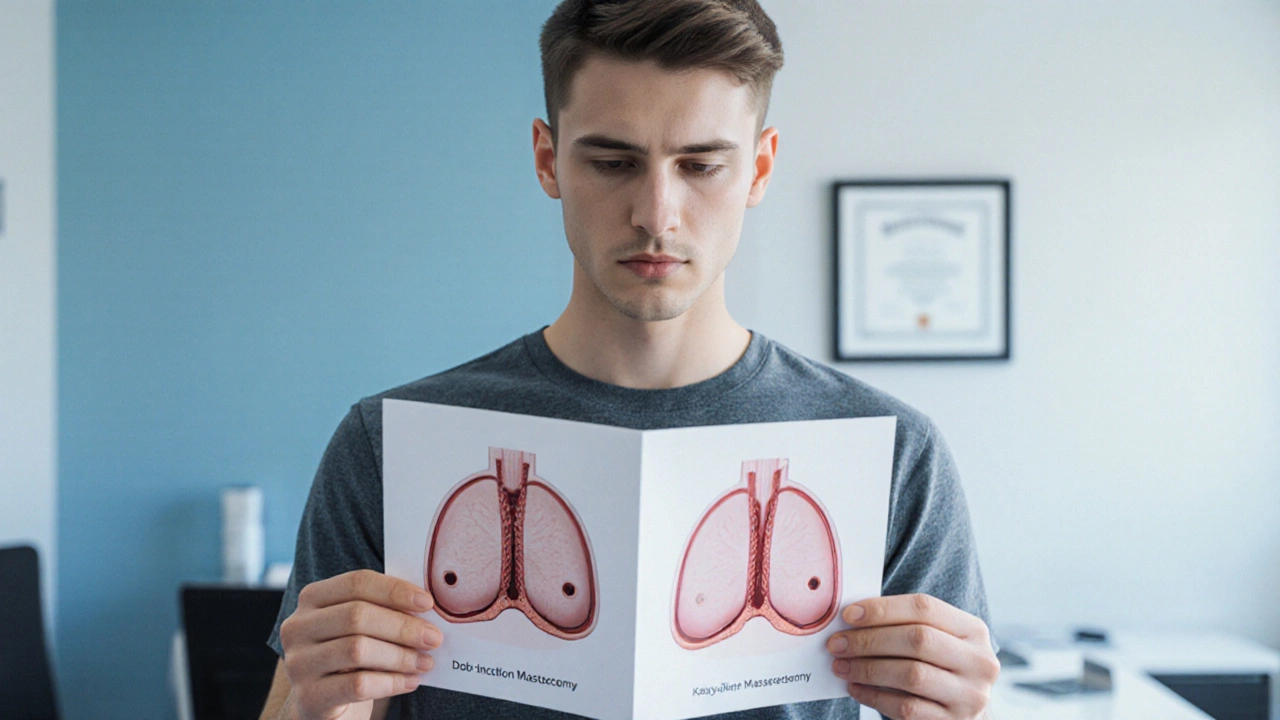

When dealing with Health Insurance for Top Surgery, the set of policies and plans that help pay for gender‑affirming chest procedures, whether through private providers or public systems, also known as top surgery coverage, you’re looking at a mix of medical necessity, policy language, and cost‑sharing rules. Understanding this mix is the first step to avoiding surprise bills and getting the care you deserve.

One major player in the UK landscape is the National Health Service (NHS), a publicly funded system that offers certain gender‑affirming surgeries when clinical criteria are met. While the NHS can cover top surgery at no direct charge, eligibility often depends on regional pathways, waiting list pressures, and specialist referrals. In contrast, Private Health Insurance, commercial policies that reimburse part or all of the surgery cost after you meet deductibles and excesses can provide faster access but usually requires you to navigate plan exclusions and pre‑authorization steps. Knowing which entity you’re dealing with determines how you’ll manage out‑of‑pocket expenses, claim forms, and follow‑up care.

Key Factors That Shape Coverage and Costs

Three core attributes drive the insurance experience: (1) Eligibility criteria – insurers often label top surgery as “elective” unless a mental‑health professional documents gender dysphoria; (2) Benefit structure – policies may offer a percentage of the surgeon’s fee, a fixed lump sum, or a per‑procedure cap; and (3) Geographic considerations – NHS coverage varies by England, Scotland, Wales, and Northern Ireland, while private plans follow underwriting rules that differ between providers. For example, a plan that covers 80 % of a £7,000 procedure after a £500 excess will leave you with roughly £1,600 out‑of‑pocket, whereas a qualifying NHS referral could reduce your cost to zero, but with a waiting time that stretches into years.

Another related entity that frequently pops up is Medical Costs of Surgery, the total price tag that includes surgeon fees, anaesthesia, hospital stay, and post‑operative care. Breaking down that total helps you compare a private quote with the NHS tariff. Surgeons often publish itemized estimates, and you can cross‑check them against the NHS Reference Costs database to spot any overcharges. When you combine a clear cost breakdown with your insurance benefit structure, you can calculate the exact amount you’ll need to budget.

Finally, it’s useful to remember that coverage decisions are not static. Policy renewals, regulatory changes, and advocacy pushes can shift how insurers classify top surgery. Keeping an eye on industry news—like recent UK proposals to make gender‑affirming care a mandatory covered service—can save you from unexpected denials. Below, you’ll find articles that dive deeper into cost comparisons between the US and UK, the pros and cons of private versus NHS routes, and practical steps for filing successful insurance claims.

Armed with these basics, you’ll be ready to explore the specific posts below, each offering a concrete look at costs, safety, and insurance strategies related to top surgery and broader healthcare choices.

How to Afford Top Surgery: Cost Breakdown & Funding Options

A practical guide breaking down top surgery costs, key price drivers, and proven ways to fund the procedure, from insurance to grants and budgeting tips.